- January 15, 2022

- Posted by: PipMaster X

- Category: Uncategorized

A forex broker is a financial services company that always provides you the trader’s access to a particular platform for buying and selling different types of foreign currencies. It’s a fact that any type of trading, especially Forex trading, requires much dedication to learning how to trade perfectly and developing a solid base of Forex knowledge. However, investing has never been easier at all, so for investing in trading you have to first open an account, then deposit funds in your account, then you’ve to use the broker’s trading platform to buy and sell currency by using margin. To start your trading career in the foreign exchange market, you have to first search for the best and reliable Forex broker. While all the transactions in the forex market are between a pair of two different types of currencies. The foreign exchange market is considered an essentially global and 24-hour a day market. However, the forex broker clients can be retail currency traders who always use these particular platforms for following the direction of currencies. Furthermore, their clients also include some large-scale financial services firms that trade on behalf of the investment banks and other such customers.

One of the main goals of forex trading is to make a profit just by exchanging one currency for another at a set price. In short, forex broker offers you the best and accessible trading services and also facilities you to both retail and institutional clients for your ease. However, forex broker trading is not a get-rich-quick process. To be successful in the forex market you have to develop patience and consistency in yourself. One of the main emerging problems with forex trading is considered a lack of transparency and indefinite regulatory structures with inadequate oversight.

The Characteristics of a Forex Broker:

The matter of fact is that lots of foreign exchange transactions are between different pairs of the currencies of the ten nations that usually make up the G10. These particular nations and their currencies are, the U.S. dollar USD, the pound sterling GBP, the Euro EUR, the Japanese yen JPY, the New Zealand dollar NZD, the Australian dollar AUD, the Canadian dollar CAD, and the Swiss franc CHF is also included in it. Usually, brokers allow their customers to trade in other currencies, including those of emerging markets. With the help of a forex broker, any trader can simply open a trade by buying a currency pair and also close his trade by selling the same pair. In case the exchange rate is much higher at the time when the trader closes his trade, the trader makes lots of profit; otherwise, the trader takes a loss.

Best Forex Broker:

Trading with the fully trusted and best forex broker is an essential factor for your success in international currency markets. The main and important thing is the broker’s status as the best and well-regulated brand. Furthermore, forex broker must be a user-friendly web-based platform with the versatility of educational resources and provide you with actionable market research. Some of the best forex brokers for the traders are,

How to choose a forex broker?

In case, if you are a new trader in the trading market, then there are lots of forex brokers for you who are looking to win your business. So, it will be pretty hard for you to consider the right one. In this particular article, we will provide you the information about the five things to consider when you’re choosing the broker that is best and perfect for you.

Top 5 Features to be considered while choosing the best forex broker:

1-Available Trading Platforms:

Whether you like to work on forex trading or want to develop complex algorithmic strategies, it is necessary to choose the right trading platform that provides you the market access and trading tools required to achieve your investment goals.

2-Best Customer Services:

In the Forex trading market trading continues 24 hours a day, so a broker’s customer support must be always available at any time when you need it. So, when you are choosing a broker, just a call can provide you with the full idea of the type of customer service that they will give you, wait times, leverage, regulations, and the other company details.

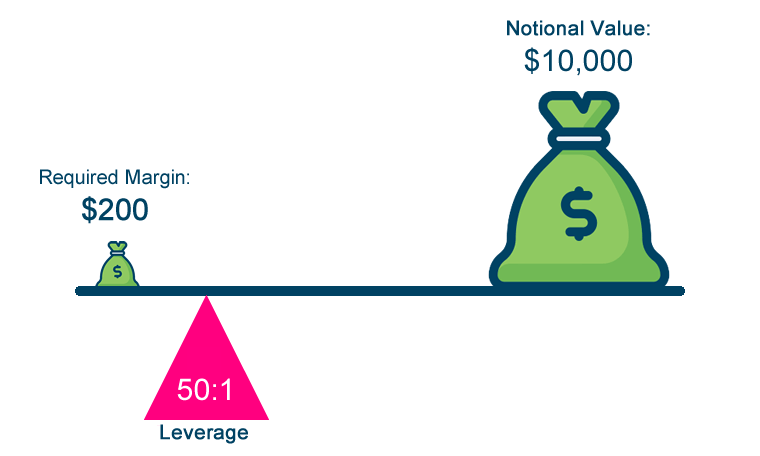

3-Focus on Margin and Leverage:

No doubt, that all the Forex traders have complete access to different leverage caps depending on their power, and the brokers they trade with leverage is a specific credit that is given to you by your forex broker. It will surely enable you to trade large amounts with a relatively small investment. So, a trader must carefully select a broker whose leverage caps correspond to the trading volume that you want to invest in however the retail customers are advocates to maintain the lower levels of the leverage.

4-Safety of your money:

First of all, while choosing the forex broker your priority must be the safety of your money whenever you are opening a forex account. Unlike the stockbrokers, a lot of brokers can simply get hacked or go bankrupt. Trading platforms are fully equipped with the best and perfect take-profit and stop-loss methods for a reason so you have to make use of them.

5-Pips and Profits:

Forex quotes always show two ratios that are the higher ask price and a lower bid price. However, its last two decimals are commonly drawn in very higher print, with the smallest price increment that’s called a percentage in point or Pips. Moreover, benefits and losses are calculated by the total number of pips that are taken or lost after the position is closed. So, you’ve to keep in mind the pips and profits criteria.

The Bottom Line:

If you are looking for the best forex broker then you are in the right place. The top 5 best and perfect techniques are described above that you have to keep in mind to choose the best broker.

Alright alright alright, gameistanpkr is pretty sweet for Pakistani players! Good options, easy to use, what’s not to like? Give it a spin fellas gameistanpkr

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.info/register-person?ref=IHJUI7TF