IC MARKET REVIEW (Update 2022)

The IC Markets Guide - In-Depth Review for 2022

The online trading platform and broker IC Markets has a reputation among active traders for having some of the best commissions and spreads. The raw spread on IC Markets is 0 pips. The company takes pride in its super fast order execution speed of 40 milliseconds, which processes over $15 billion USD or around £10 billion Pound Sterling daily in trades. IC Markets can be considered one of the few brokers with a trading platform of institutional quality.

The experts writing this IC Markets review have over 10 years of experience in the financial industry, including Forex, CFDs, Spread Betting, Share dealing, and Cryptocurrencies.

It is not applicable to US users..

Trading Advantages with IC Market

Table of Contents

History of IC Markets?

IC Markets was founded in 2007 as a global online trading platform for financial instruments and a multi-asset broker

In over 15 years, IC Markets has grown to offer retail investors a variety of trading options, including Forex, CFDs, Spread Betting, Share dealing, and Cryptocurrencies.

IC Markets are a worldwide broker. IC Markets have an administrative center in Australia.

When trading in the monetary markets it tends to be exceptionally tedious to observe a broker that addresses your issues.

We will make a plunge this IC Markets survey and evaluate how well the IC Markets stage capacities in its job as a global different monetary resource trading stage for traders in 2022.

Frequently you need to visit and peruse many broker sites all of which have various employments of language. The phrasing can be exceptionally confounding. Picking a web-based broker like IC Markets can be troublesome. For a fledgling, the initial not many obstacles can come as what seems, by all accounts, to be a perplexing versatile or web based trading stage, hard to comprehend venture phrasing and confounding charge structures. In our survey of IC Markets we breakdown the advantages and disadvantages. What IC Markets can offer, what nations IC Markets are accessible in. Who IC Markets are controlled by and that’s just the beginning.

This survey of the IC Markets stage is extremely nitty gritty. Assuming you are keen on trading with IC Markets in any way if it’s not too much trouble, invest in some opportunity to peruse and explore the entire IC Markets audit.

We have attempted to clarify the intricate details of monetary trading through the IC Markets stage as evidently as conceivable so you the trader are pretty much as educated as conceivable before you begin to utilize the IC Markets trading apparatuses and keeping and pulling out assets from IC Markets.

Features of IC Markets

| 💰 Min Deposit | 200 |

| 👱♂️ Used By | 180,000 IC Markets users and traders |

| 📆 Founded | 2007 |

| 🌍 HQ | Australia |

| 👮♂️ Regulation | Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC) |

| 🚫 Excluded Countries | IC Markets is not available in the following countries : US |

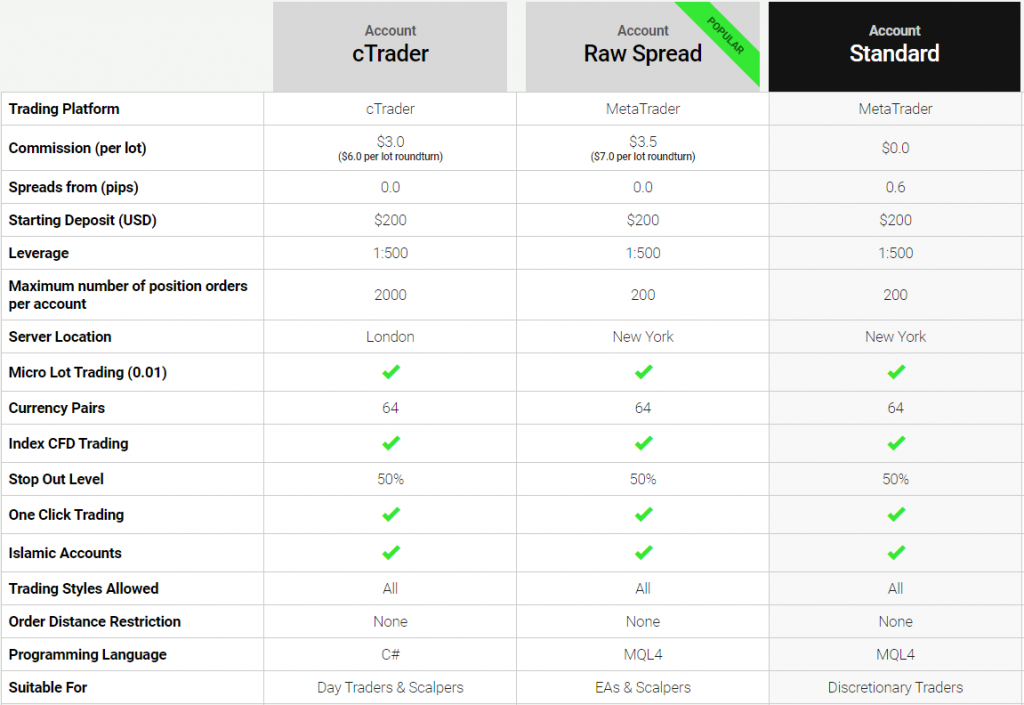

IC Markets Account Comparison

IC Markets Raw Pricing offering and huge item range are incorporated across all record types. Appropriate for both new and experienced traders, basically pick your favored trading platform and evaluating model to begin.

cTrader Raw Account

- Low ECN broker spreads + $3.00 USD per lot commission

- Use of cTrader forex trading platform

- C# programming language

- Provides an institutional-grade trading environment

Raw Spread Account

- Lowest ECN broker spreads + $3.50 per lot commission

- Use of MetaTrader 4 forex trading platform

- MLQ4 programming language

- Ideal if you are looking to create Expert Advisor or day trading strategies

Standard Account

- No commissions on trades, rather larger spreads

- Use of the MetaTrader 4 forex trading platform

- Designed for beginner forex traders

The broker offers an account type for all styles and levels of trading experience. Forex traders hoping to execute computerized trading techniques or exchange high volumes will favor the Raw Account's low expenses. Then again, those new to trading will the basic estimating of IC Markets Standard Account engaging, as the no commission structure implies there is no requirement for complex brokerage charge computations.View the Standard versus Raw Spread correlation table to track down the right account for your requirements.

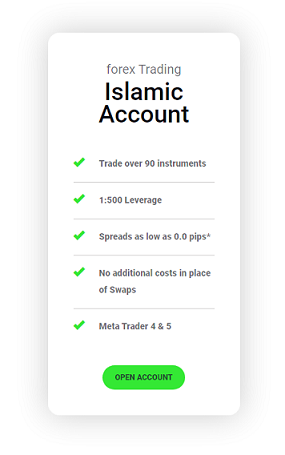

Islamic Account Option

IC Markets offers Islamic accounts (also known as swap free accounts) for clients who cannot earn or pay interest due to their religious beliefs. The swap free option** is available on both our Raw Spread and Standard account types on the MT4, MT5 and cTrader platforms.

Overnight Financing Charges

Swap free accounts do not pay or earn swap or interest on any trades for Currencies, Metals & Indices excluding exotic Currency Pairs, Brent, Natural Gas, and WTI’s, where a small financing charge is applicable overnight. Any trades open for more than 1 day in the below mentioned pairs will be charged a flat rate financing charge. Rates & holding period is subject to change to reflect market conditions when necessary. IC Markets Raw Spread and Standard Account commissions and spreads apply.

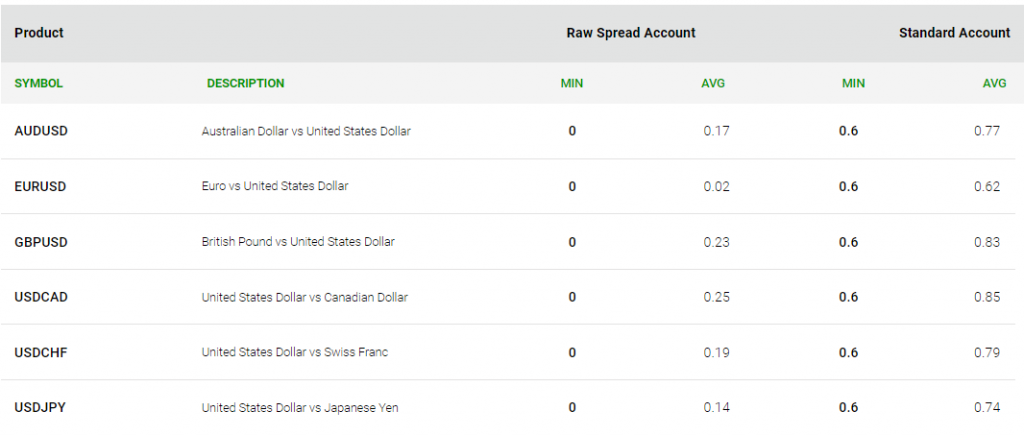

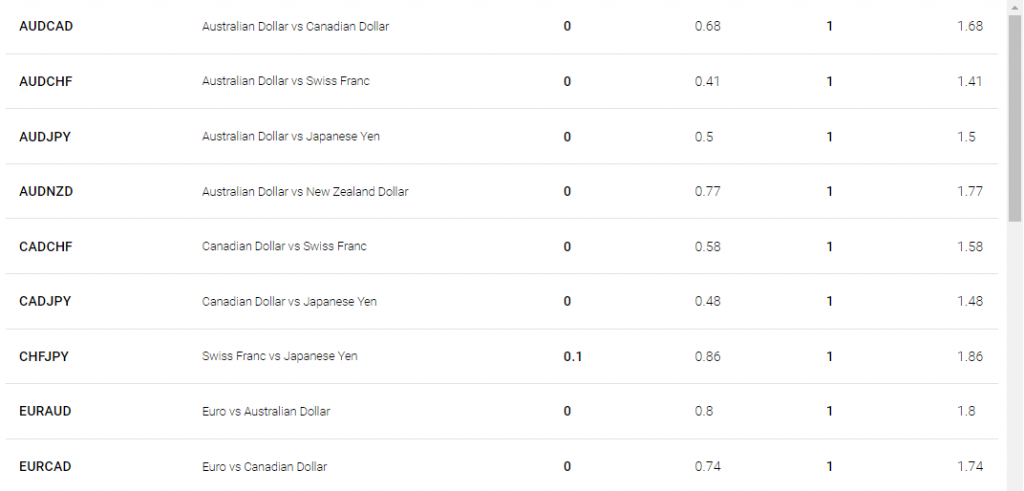

IC Markets Spreads

IC Markets ready to offer tight spreads in every one of our platforms on account of our blend of liquidity suppliers.

valuing comprises of more than 25 distinctive liquidity suppliers guaranteeing our spreads stay tight and liquidity profound 24/5

Low Commission

IC Markets offer 10 base monetary forms including the AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD to HKD. The base money a trader picks when opening an account will decide the commission rate you pay. Underneath shows the commission for the MetaTrader 4 Raw account.

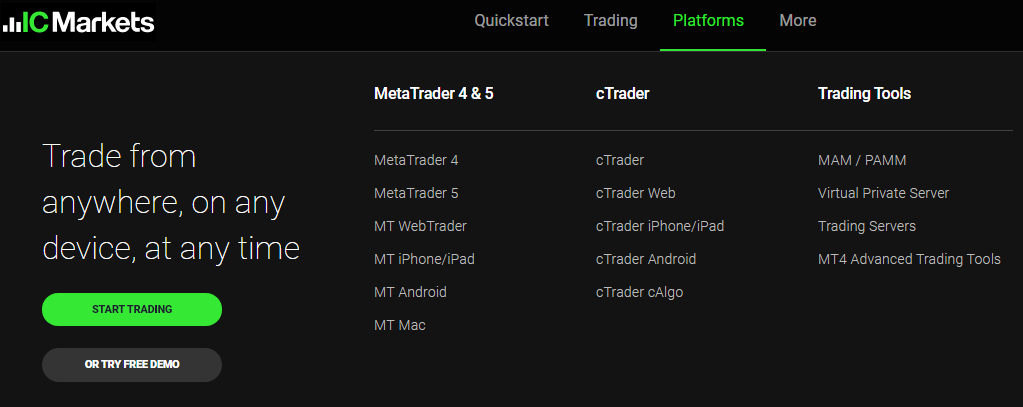

IC Markets Trading Platforms

IC Markets offer the three most well known forex trading platforms around the world. The MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader forex platforms offer the best work area trading platforms and portable trading application choices. This incorporates every cell phone, for example iPhone, iPad and Android applications, with the two demos and live accounts accessible.

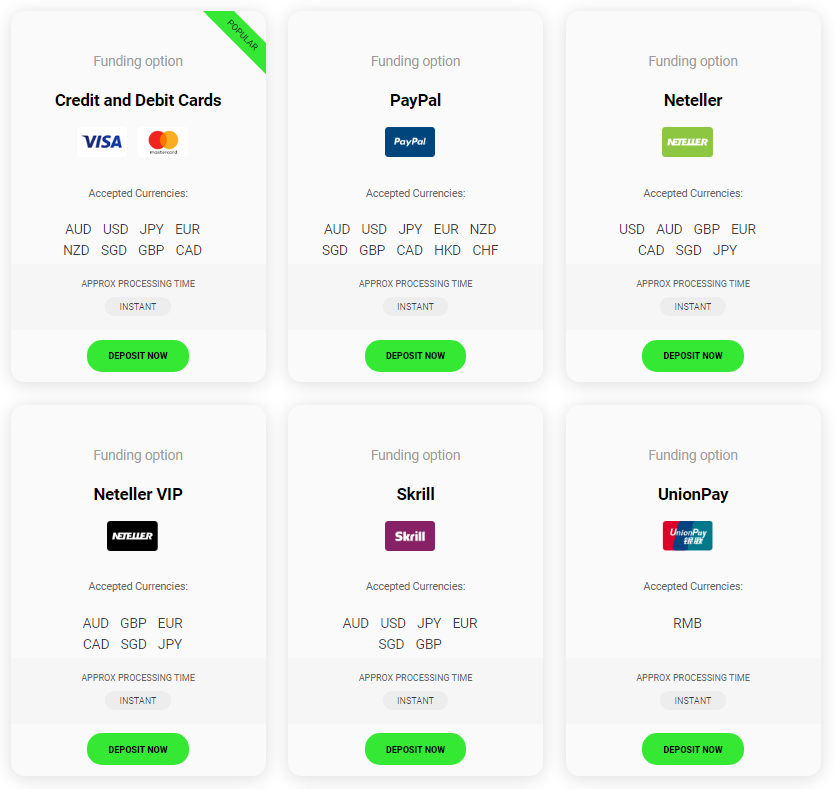

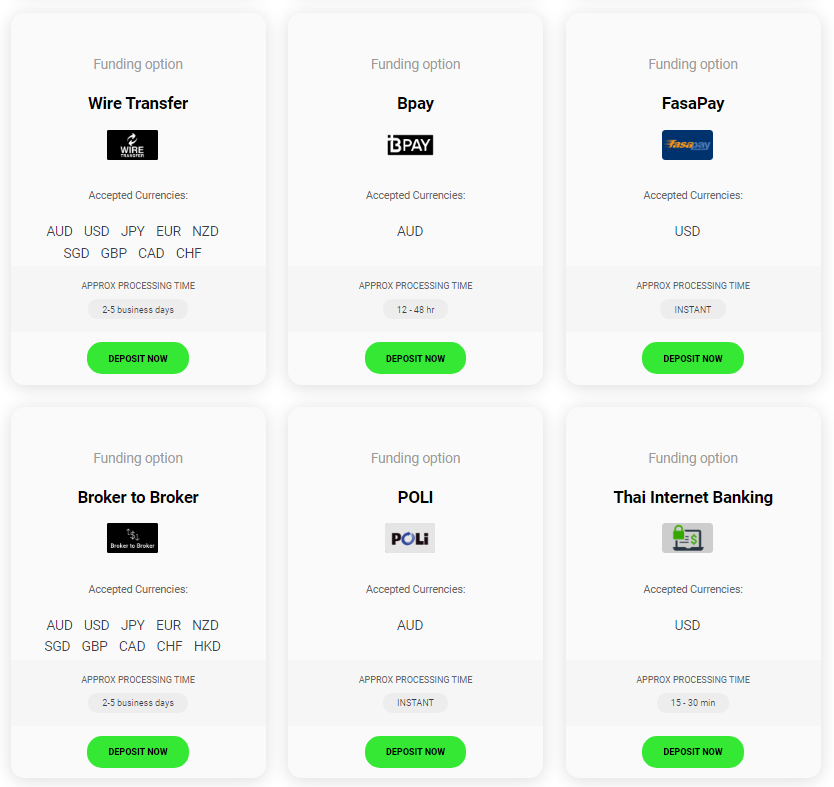

Account Funding

IC Markets requires you to make an initial minimum deposit of USD $200 (or equivalents) when opening a trading account. There are 19 funding methods (most fee-free) to deposit funds, including:

Credit Cards and Debit Cards

Wire Transfer and Bpay (Australia Only)

Neteller and FasaPay (US only)

Skrill and Union Pay (China only)

IC Markets Withdrawals

Similarly as with deposits, making an IC Markets withdrawal brings about no expenses, albeit certain banks might charge $20 AUD for global bank moves. Inside the safe customer, region withdrawals can be mentioned with the day by day remove time at 12:00 AEST. The time it takes to get the withdrawn sum relies upon the strategy utilized including:

Paypal/Neteller/Skrill = Instant

Homegrown Wire Transfer = 1 working day

Visas and Debit Cards = 3 – 5 working days

It ought to be noticed that the withdrawal strategy should be equivalent to the deposit technique picked. For instance, on the off chance that you utilize a charge card to set aside an installment, a similar card should be utilized for the withdrawal. Webmoney additionally used to be offered yet is presently not accessible.

Regulation

IC Markets is authorised and regulated by the Australian Securities and Investments Commission (ASIC). IC Markets is monitored by one of the strictest financial regulatory bodies in the world.

ASIC (Australia)

In Australia, IC Markets is managed by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services License (AFSL no. 335692). ASIC has a few shields to secure forex traders, including the necessity for brokers to hold assets in an isolated financial balance, negative equilibrium insurance, and closeout edges. Also, influence covers are upheld for every resource class and sort of CFD.

CySEC (Cyprus)

IC Markets European branch is directed by the Cyprus Securities and Exchange Commission (CySEC). Brokers in this locale adhere to forex not set in stone by the European Securities and Markets Authority (ESMA). CySEC and the ESMA have severe guidelines covering a few regions including:

Diminished influence (talked about in the following area)

Limitations on rewards and advancements

Negative equilibrium assurance

Seychelles

For traders outside of Australia and the EU, IC Markets has an auxiliary under the name Raw Trading Ltd, enlisted in Seychelles (Africa). The organization number is 8419879-2 and the seller permit number is SD018. The Financial Services Authority of Seychelles (FSC) is a seaward monetary power that authorizes less financial backer insurances than CySEC or ASIC. This locale is utilized for encompassing African nations which is normal among the best forex brokers in Nigeria.

105 Comments

IC Markets offers some of the best commissions and spreads in the industry, with a raw spread of 0 pips and super fast order execution speed of 40 milliseconds.

When choosing a broker, it can be difficult to navigate the confusing language and structures. Our IC Markets review aims to make the process as clear as possible.

IC Markets’ platform is very user-friendly and easy to navigate, even for beginners.

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]

[…] try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a […]