IC MARKETS FEE, SPREADS , COMMISSION REVIEW :

Dolar Amerika 200

ASIC

Meja Dagangan

Meja DaganganMetaTrader 4

ya

Jumlah Pasangan

Jumlah Pasangan65

ya

rendah

Masa Pengaktifan Akaun

Masa Pengaktifan Akaun24 Jam

Visit Broker

Visit Broker

Isi kandungan

In general, online brokerages charge lower brokerage fees than traditional brokerages do – this is largely due to the fact that online brokerages’ businesses can be scaled much better: From a technical perspective, it doesn’t make that much of a difference whether they have 10 clients or 5000 clients.

Namun begitu, this does not imply that they do not charge any fees at all.

You will be charged a fee at various events. You should usually lookout for these 3 types of fees:

Fees for trading: ini adalah yuran pembrokeran yang anda bayar apabila anda membeli saham Apple atau ETF. Sebuah komisen, sebar, atau kadar pembiayaan adalah apa yang anda bayar.

Sesetengah broker menggunakan ketiga-tiganya. :

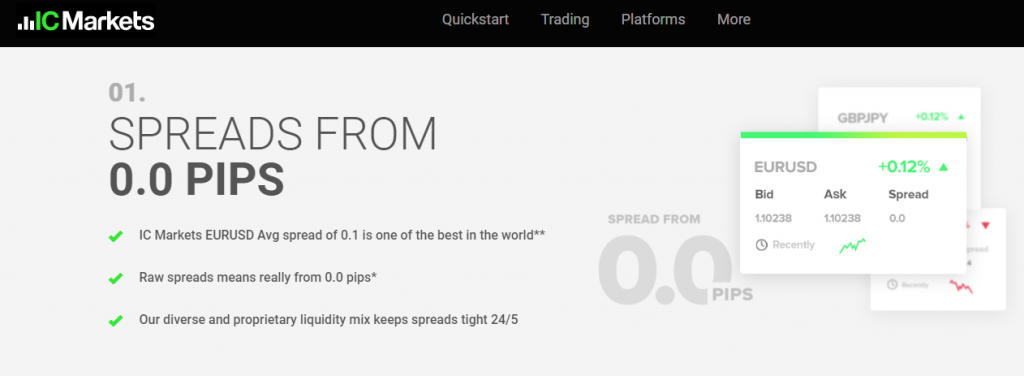

Spread ialah perbezaan antara harga beli dan harga jualan.

Komisen sama ada tetap atau berdasarkan jumlah dagangan.

Jika anda memegang jawatan berleveraj lebih daripada satu hari, anda dikenakan kadar pembiayaan atau kadar semalaman.

Yuran bukan dagangan: Ini berlaku berkaitan dengan beberapa operasi yang anda buat dalam akaun anda, i.e. mendepositkan wang ke akaun anda, mengeluarkan wang daripadanya atau tidak berdagang untuk jangka masa yang panjang.

Bayaran yang dikenakan oleh IC Markets pada umumnya adalah rendah. Broker tidak mengenakan bayaran pembrokeran untuk perkhidmatan yang dilakukan oleh broker lain, atau mereka mengenakan bayaran yang sedikit. Justeru, anda boleh menggunakan IC Markets walaupun anda kerap berdagang, seperti beberapa kali seminggu atau setiap hari. Berikut ialah gambaran keseluruhan tahap tinggi yuran IC Markets

| Aset | Tahap yuran | Syarat yuran |

|---|---|---|

| Yuran saham AS | - | Tidak tersedia |

| Yuran EURUSD | rendah | $3.5 setiap lot ditambah kos taburan |

| Yuran dana teknologi AS | - | Tidak tersedia |

| Yuran tidak aktif | rendah | Tiada yuran tidak aktif |

Yuran dagangan IC Markets:

Yuran dagangan di IC Markets adalah rendah.

Forex brokers’ trading fees are extremely hard to compare.Rather than providing long fee tables, kami membandingkan broker dengan mengira semua yuran perdagangan contoh untuk dua pasangan mata wang.

dua pasangan mata wang yang paling popular ialah EURUSD dan EURGBP.

Penanda aras super catch-all ini menggabungkan spread dan kos pembiayaan untuk semua wakil.

Yuran Ujian EURUSD : $5.8

Yuran Ujian EURUSD : $7.3

Kadar pembiayaan EURUSD: 1.2% (Tukar)

Kadar pembiayaan EURGBP: 1.5% (Tukar)

Yuran penukaran mata wang:

Pasaran IC will charge a Currency Conversion Fee for all exchanges on instruments named in a cash different to the money of your account. The expense is charged as the accompanying: Exchange rate got from liquidity suppliers in addition to an increase

IC Markets non-trading fees

With regards to checking out all the non-trading expenses Pasaran IC is a modest intermediary. This implies that they don’t charge you a great deal for non-trading related exercises on your trading account, similar to withdrawal expense.

Non-trading expenses incorporate different business expenses and charges at Pasaran IC that you pay not connected with trading resources. Among some others, regular non trading expenses are withdrawal charge, store expense, latency charge and account charge.

IC Markets withdrawal fee

Deposit fees are applied when you send money to your trading account from your bank account. Usually brokers don’t charge money for that and IC Markets is not different: you will see the exact same amount on your brokerage account that you sent by any of the deposit methods IC Markets offers.

IC Markets non-trading fees

Not at all like most of the internet based dealers we have inspected IC Markets doesn’t charge a withdrawal expense. This implies that you’ll see a similar measure of cash on your financial balance that you moved from your investment fund.

IC Markets inactivity fee

IC Markets doesn’t have any significant bearing an inertia expense which is extraordinary in light of the fact that your account won’t be charged regardless of whether you exchange for a more drawn out time .

PENILAIAN KAMI

9 Komen

The IC Markets trading platform is of institutional quality, making it a great choice for active traders.

IC Markets offers a minimum deposit of 200 and has 180,000 pengguna, making it a popular choice among traders.

I’ve been very impressed with the fast and efficient execution on IC Markets.

I’ve found IC Markets to be a reliable and trustworthy broker for my trading needs.

IC Markets has been a great choice for me as a trader, the platform is very user-friendly, and customer service is top-notch.

IC Markets has a great reputation in the industry and it’s easy to see why after trading with them for a while.

IC Markets has a great mobile trading app, which makes it easy to keep track of my trades on the go.

IC Markets has a great reputation for providing fast and efficient execution, menjadikannya pilihan yang bagus untuk peniaga.

Thanks for finally writing about > How Much Commission Does

IC Market Charge? – List Best Forex Brokers < Liked it!