IC MARKETS FEE, SPREADS , COMMISSION REVIEW :

米ドル 200

ASIC

トレーディングデスク

トレーディングデスクMetaTrader 4

はい

合計ペア

合計ペア65

はい

低い

アカウントのアクティブ化時間

アカウントのアクティブ化時間24 時間

ブローカーにアクセス

ブローカーにアクセス

目次

In general, online brokerages charge lower brokerage fees than traditional brokerages do – this is largely due to the fact that online brokerages’ businesses can be scaled much better: From a technical perspective, it doesn’t make that much of a difference whether they have 10 clients or 5000 clients.

しかし, this does not imply that they do not charge any fees at all.

You will be charged a fee at various events. You should usually lookout for these 3 types of fees:

Fees for trading: これらは、Apple株またはETFを購入するときに支払う仲介手数料です。. 手数料, 拡大, または融資率はあなたが支払うものです.

一部のブローカーは3つすべてを適用します. :

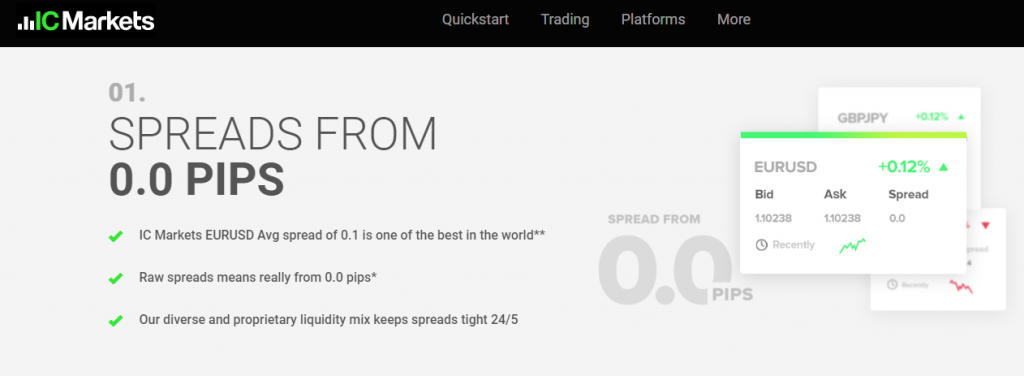

スプレッドは、買い価格と売り価格の差です.

手数料は固定されているか、取引量に基づいています.

レバレッジポジションを1日以上保持している場合, ファイナンスレートまたはオーバーナイトレートが請求されます.

非取引手数料: これらは、アカウントで行う一部の操作に関連して発生します, つまり、. あなたの口座にお金を預ける, それからお金を引き出すか、長期間取引しない.

ICMarketsが請求する料金は一般的に低いです. ブローカーは、他のブローカーが行うサービスの仲介手数料を請求しません, または彼らは少量を請求します. したがって, 頻繁に取引する場合でもICマーケットを使用できます, 週に複数回または毎日など. 以下は、ICMarketsの料金の概要です。

| 資産 | 料金レベル | 料金条件 |

|---|---|---|

| 米国の株式手数料 | - | 利用不可 |

| EURUSD手数料 | 低い | $3.5 ロットあたりプラススプレッドコスト |

| 米国の技術ファンド料金 | - | 利用不可 |

| 非アクティブ料金 | 低い | 非アクティブ料金なし |

ICマーケットの取引手数料:

ICマーケットでの取引手数料は安い.

Forex brokers’ trading fees are extremely hard to compare.Rather than providing long fee tables, 2つの通貨ペアの取引例のすべての手数料を計算してブローカーを比較します.

最も人気のある通貨ペアの2つは、EURUSDとEURGBPです。.

このスーパーキャッチオールベンチマークには、すべての代表者のスプレッドと資金調達コストが組み込まれています.

EURUSDテスト料金 : $5.8

EURUSDテスト料金 : $7.3

EURUSDの資金調達率: 1.2% (スワップ)

EURGBPの資金調達率: 1.5% (スワップ)

為替換算手数料:

IC市場 will charge a Currency Conversion Fee for all exchanges on instruments named in a cash different to the money of your account. The expense is charged as the accompanying: Exchange rate got from liquidity suppliers in addition to an increase

IC Markets non-trading fees

With regards to checking out all the non-trading expenses IC市場 is a modest intermediary. This implies that they don’t charge you a great deal for non-trading related exercises on your trading account, similar to withdrawal expense.

Non-trading expenses incorporate different business expenses and charges at IC市場 that you pay not connected with trading resources. Among some others, regular non trading expenses are withdrawal charge, store expense, latency charge and account charge.

IC Markets withdrawal fee

Deposit fees are applied when you send money to your trading account from your bank account. Usually brokers don’t charge money for that and IC Markets is not different: you will see the exact same amount on your brokerage account that you sent by any of the deposit methods IC Markets offers.

IC Markets non-trading fees

Not at all like most of the internet based dealers we have inspected IC Markets doesn’t charge a withdrawal expense. This implies that you’ll see a similar measure of cash on your financial balance that you moved from your investment fund.

IC Markets inactivity fee

IC Markets doesn’t have any significant bearing an inertia expense which is extraordinary in light of the fact that your account won’t be charged regardless of whether you exchange for a more drawn out time .

私たちの評価

9 コメント

The IC Markets trading platform is of institutional quality, making it a great choice for active traders.

IC Markets offers a minimum deposit of 200 and has 180,000 ユーザー, making it a popular choice among traders.

I’ve been very impressed with the fast and efficient execution on IC Markets.

I’ve found IC Markets to be a reliable and trustworthy broker for my trading needs.

IC Markets has been a great choice for me as a trader, the platform is very user-friendly, and customer service is top-notch.

IC Markets has a great reputation in the industry and it’s easy to see why after trading with them for a while.

IC Markets has a great mobile trading app, which makes it easy to keep track of my trades on the go.

IC Markets has a great reputation for providing fast and efficient execution, making it a great choice for traders.

Thanks for finally writing about > How Much Commission Does

IC Market Charge? – List Best Forex Brokers < Liked it!