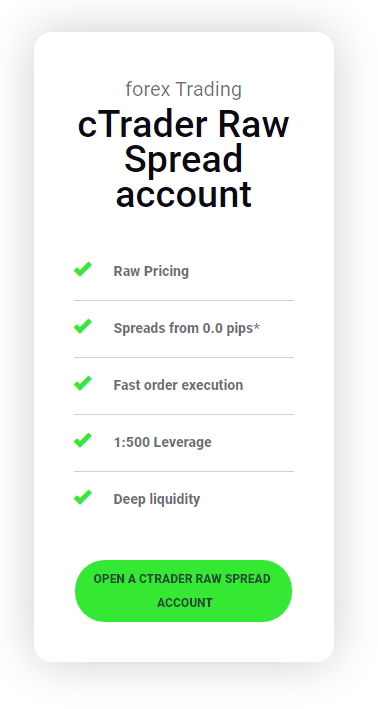

cTrader Raw Spread Account

USD 200

ASIC

Trading Desk

Trading DeskMetaTrader 4

Yes

Total Pairs

Total Pairs65

Yes

Low

Account Activation Time

Account Activation Time24 Hours

Visit Broker

Visit Broker

Table of Contents

CTrader is built to deliver demanding performances, and when paired with IC Market's raw pricing and unrivaled execution speeds, it makes an excellent addition to your trading arsenal and helps you achieve better results.

The cTrader platform from IC Markets is an award-winning trading platform designed from the ground up with Forex CFD trading in mind.

cTrader Video:

IC MARKETS CTRADER Low Spreads

Globally, IC Markets has some of the tightest spreads of any Forex broker. There is no minimum spread on the cTrader platform and spreads on the EUR/USD can often be seen at 0.0 pips during European and North American trading sessions. The average spread on EUR/USD is 0.01.

In IC Markets’ pricing connector, up to 25 different pricing sources are aggregated, allowing IC Markets to always source the best possible price for their clients while keeping our spreads as tight as possible, especially during high volatility times like news announcements.

Fast order execution

ICM Markets’ cTrader platform is housed in the LD5 IBX Equinix Data Center in London. This financial ecosystem is home to over 600 buy and sell side firms, exchanges, trading venues, market data providers, and service providers.

Its backend allows simultaneous execution of orders across IC Markets and Thiers pricing providers, enabling you to take advantage of any market condition. Its connectivity ensures low latency and fast execution of trades, enabling you to take advantage of every opportunity.

It is ideal for automated and high frequency trading, as well as scalping and automated trading. IC Markets cTrader server has an average latency of under 1 millisecond to major VPS providers collocated in LD5 IBX data centers or via dedicated lines to nearby data centres.

Spreads from 0.0 pips

The spreads at IC Markets are some of the tightest among all forex brokers worldwide.

Spreads start at 0.0 pips on the MetaTrader 4 and 5 platforms, and the average EURUSD spread is 0.1 pips 24/5. This is the tightest EURUSD spread globally.

By aggregating up to 25 different prices providers, we are always able to provide the best price to our clients and to keep our spreads tight, especially during high volatility periods.

ICMarkets Scalping Allowed

CTrader platform offered by IC Markets has no restrictions on trading. CTrader offers some of the best conditions for scalping and high-frequency trading globally. As there is no minimum order distance and no freeze level, traders can place orders between the spread.

In other words, orders including stoploss orders can be placed as close to the market price as you like.

Additionally, IC Markets allows traders to hedge positions because there is no first in first out (FIFO) rule. Traders do not pay margin on hedged trades, and margin netting is available.

ICMarkets Market Depth

Through cTrader’s depth of market, you can see the full range of executable prices coming directly from our pricing aggregator. Orders are filled using Volume Weighted Average Pricing (VWAP) in the IC Markets bridge.

By displaying the available volumes for each price level and asynchronous spot prices for each currency pair, cTrader provides complete transparency of the liquidity for each currency pair. In addition, the platform’s low latency provides the tightest possible spreads.

64 Currencies & Metals + 15 CFDs

With a spread from 1 point, you can trade 64 currency pairs and 15 major equity indices throughout the day, including the FTSE 100, S&P/ASX 200, and Dow Jones Index.

Leverage up to 1:500

IC Markets’ cTrader platform supports leverage up to 1:500, so traders can adjust their leverage levels to suit their trading style. Automated trading strategies can also be used with higher leverage.

All Major Account Currencies Supported

Accounts may be opened in any of the ten supported base currencies: USD, AUD, EUR, GBP, SGD, HKD, NZD, JPY, CHF & CAD.

OUR RATING