ACCOUNT FUNDING & WITHDRAWAL REVIEW

IC Markets Review

USD 200

ASIC

Trading Desk

Trading DeskMetaTrader 4

Yes

Total Pairs

Total Pairs65

Yes

Low

Account Activation Time

Account Activation Time24 Hours

Visit Broker

Visit Broker

Table of Contents

You are really interested and want to learn about Forex trading investment . But what you are wondering about is not knowing which exchange to pour capital into, which is reputable, safe and quickly profitable. IC Markers is really a broker that won’t let you down because it meets almost fully in terms of prestige, order execution speed per millisecond, high leverage, low spread costs , etc.

Account Funding

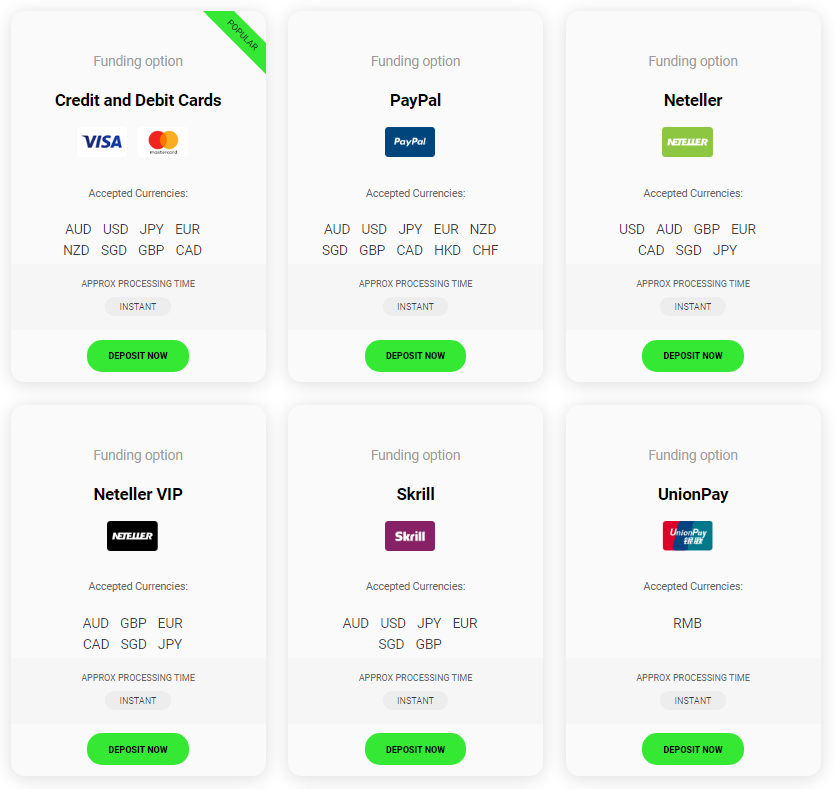

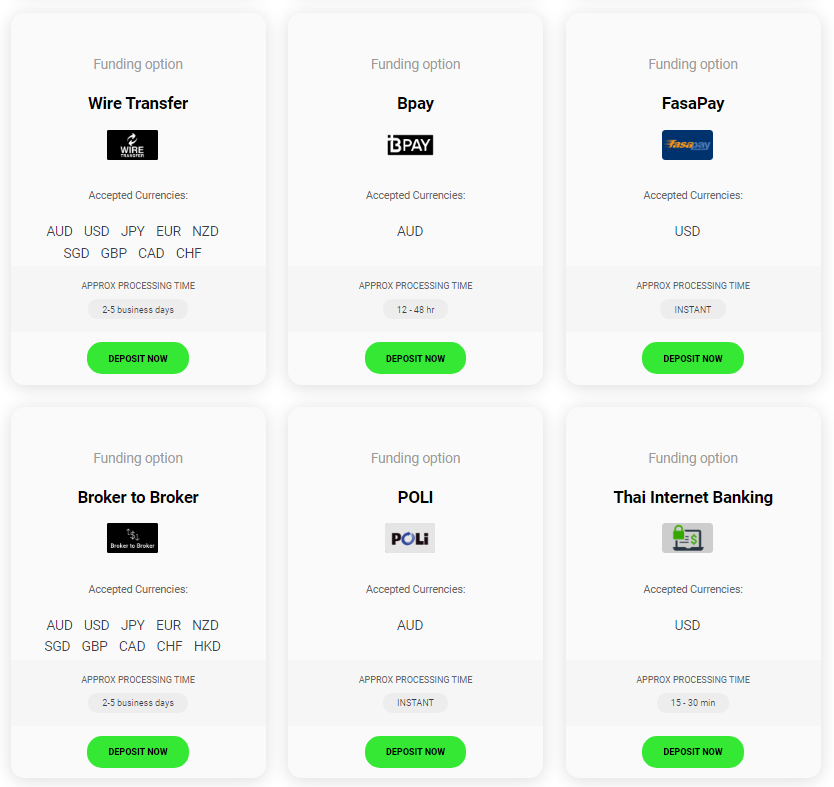

The deposit methods used at IC Markets include instant and free deposits. There are over 15 different funding options in 10 different base currencies.

IC Markets requires you to make an initial minimum deposit of USD $200 (or equivalents) when opening a trading account. There are 19 funding methods (most fee-free) to deposit funds, including:

Credit Cards and Debit Cards

Wire Transfer and Bpay (Australia Only)

Neteller and FasaPay (US only)

Skrill and Union Pay (China only)

Security of Funds

Bank Fees

IC Markets Withdrawals

Similarly as with deposits, making an IC Markets withdrawal brings about no expenses, albeit certain banks might charge $20 AUD for global bank moves. Inside the safe customer, region withdrawals can be mentioned with the day by day remove time at 12:00 AEST. The time it takes to get the withdrawn sum relies upon the strategy utilized including:

Paypal/Neteller/Skrill = Instant

Homegrown Wire Transfer = 1 working day

Visas and Debit Cards = 3 – 5 working days

It ought to be noticed that the withdrawal strategy should be equivalent to the deposit technique picked. For instance, on the off chance that you utilize a charge card to set aside an installment, a similar card should be utilized for the withdrawal. Webmoney additionally used to be offered yet is presently not accessible.

Time process

Credit / Debit Cards

Electronic method

bank transfer

OUR RATING

10 Comments

IC Markets is a global broker with an administrative center in Australia, offering a wide range of trading options to retail investors.

IC Markets offers some of the best spreads in the industry, making it a great choice for traders looking to maximize their profits.

IC Markets offers a great web-based trading platform that is easy to navigate and use.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Эскорт агентство Москва предлагает индивидуальный

подход %urlt%

Агентство эскорта СПб: подбор спутницы

https://spb-elite-escorts.com/

Наша философия — ваше удовлетворение https://hrcho.ru/

Your article helped me a lot, is there any more related content? Thanks!

Pin777 is pretty solid. Good game variety and I’ve had some decent wins here. Recommended if you’re looking for a reliable place to play pin777.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.