FBS REVIEW (Update 2022)

The FBS Broker Guide - In-Depth Review for 2022

FBS has introduced a new Crypto account designed specifically to trade cryptocurrencies, currency USD (Tether). The new Crypto account offers more than 100 instruments, both real and demo versions, and relatively low spreads, with a leverage of one to five.

The experts writing this FBS review have over 10 years of experience in the financial industry, including Forex, CFDs, Spread Betting, Share dealing, and Cryptocurrencies.

It is not applicable to US users..

Trading Advantages with fbs broker

Table of Contents

History of FBS Broker ?

CFD broker FBS was founded in 2009 in Cyprus. It is regulated by multiple financial authorities around the world, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the International Financial Services Authority.

Over 17 000 000 traders and 410 000 partners have already chosen FBS as their preferred broker.

Every day, 7000 traders and partners open FBS accounts. Every 20 seconds, a client withdraws profits. Half of FBS clients multiply their initial deposit by 8-10 times.

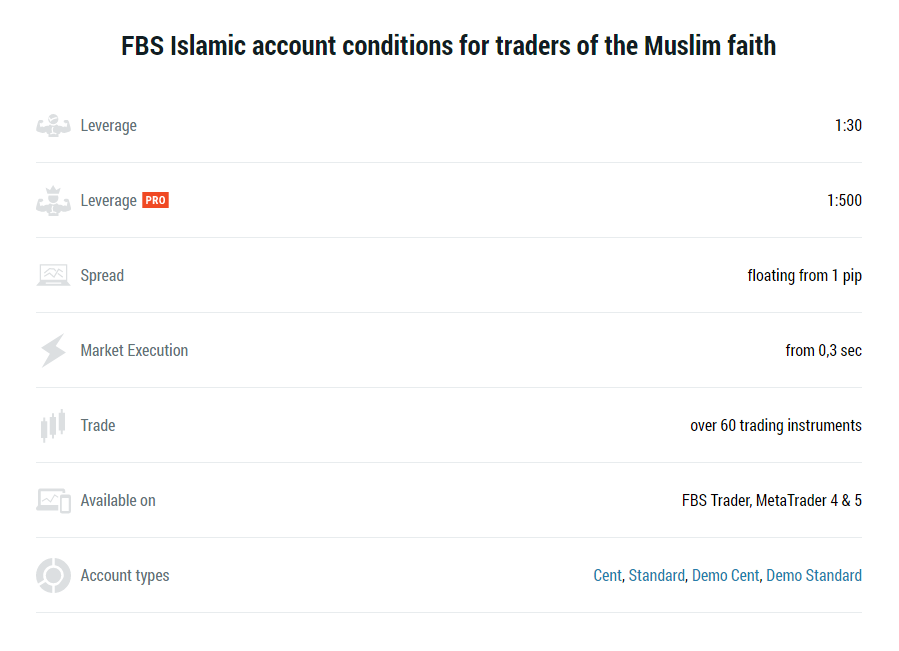

FBS understands that different customers have different needs, so for Muslim traders FBS have swap-free accounts (also known as Islamic accounts), which do not contradict with the teachings of Islam.

To diminish your trading costs and amplify benefit, exchange with restricted spreads given by FBS organization.

FBS provides the following types of spread:

Floating, starting from 0.2 pip;

Fixed, starting from 3 pip;

Trading without spread (fixed spread of 0 pip).

Spread type and value are determined by the account type.

Features of FBS BROKER

| 💰 Min Deposit | 10 EUR for EU / 1 USD for Global, |

| 👱♂️ Used By | 170,000 FBS users and traders |

| 📆 Founded | 2009 |

| 🌍 HQ | Cyprus |

| 👮♂️ Regulation | IFSC, CySEC, ASIC, FSCA |

| 🚫 Excluded Countries | FBS is not available in the following countries : Belize, the USA, Brazil, Thailand and Japan |

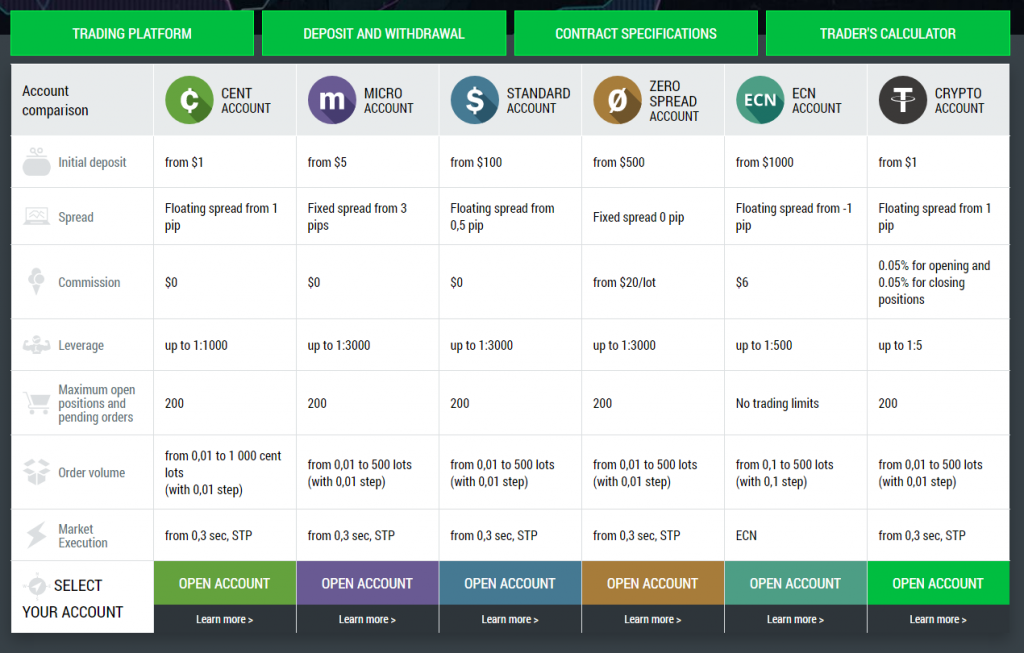

FBS Broker Account Comparison

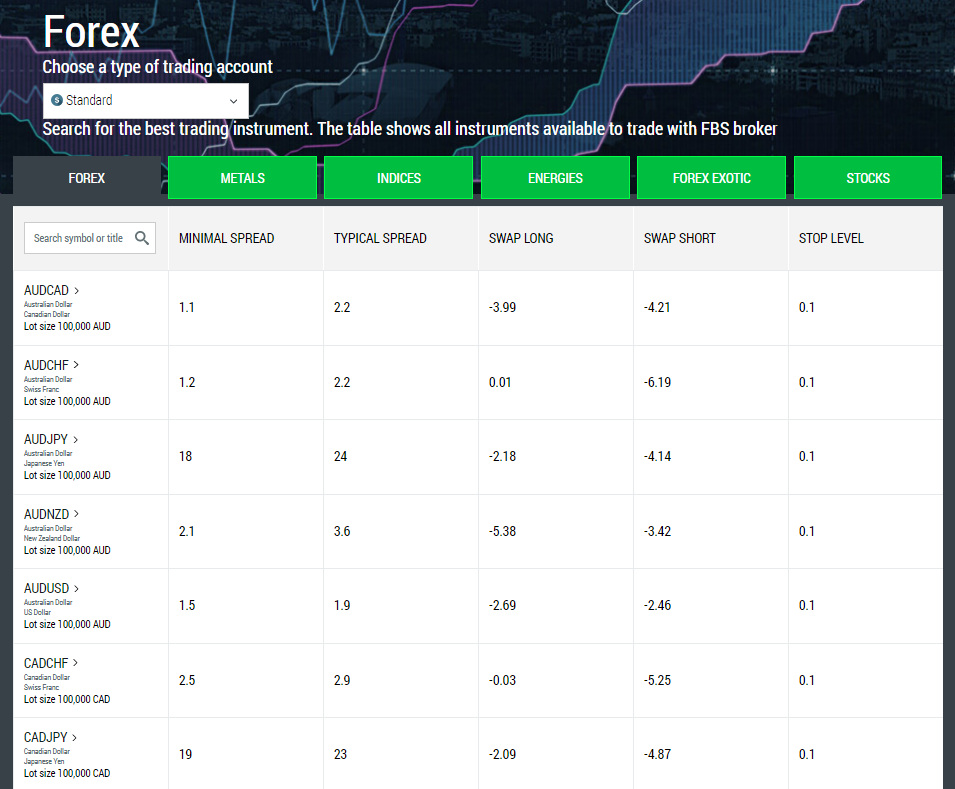

Among the instruments available at FBS are Forex, metals, indices, energies, Forex exotics, stocks, and even cryptocurrencies. The assets available are based on the account type you select.

CEN ACCOUNT

- A cent account is a trading account where the balance is displayed in cents, and all transactions are carried out in cents. If you deposit $10, you will have 1000 cents in your account. A cent account is low-risk, so it is an excellent selection for traders.

- Moreover, this type of account can be attractive to experienced traders who want to test out new strategies.

- Cent accounts allow people to trade smaller lots and open accounts with a lower initial deposit than any other account.

- To open the Cent account at FBS, you need to make an initial deposit of $1 only – less than you pay for a cup of coffee!

MICRO ACCOUNT

- To know every one of the insights regarding your benefit, Micro account is your decision.

- The Micro account can assist you with working out your benefit exactly with the trading devices that FBS offers you, like Trader’s adding machine. All you want to open the Micro account at FBS is to put aside an underlying installment of $5 and confirm your account.

- The Micro account furnishes traders with our best rewards – 100 percent Deposit Bonus, Level Up Bonus, and Cashback. It has a fixed spread from 3 pips, influence up to 1:3000, and turns out best for the people who need to acquire insight and expert trading system. The Micro account upholds the accompanying trading instruments: Forex, metals. At FBS, the Micro account is accessible on MetaTrader 4

STANDARD ACCOUNT

- Standard account is great for traders searching for conventional trading experience. The Standard account offers super serious spreads with practically no commissions.

- At FBS, you are allowed to choose how much influence you need (up to 1:3000), and you are free to profit from our alluring rewards, for example, Level Up Bonus, that surrenders you to $140 free of charge and 100 percent Deposit Bonus that duplicates your underlying store.

- The Standard account upholds the accompanying trading instruments: Forex, metals, records, energies, Forex intriguing, and stocks. At FBS, you can open the Standard account on MetaTrader 4 or MetaTrader 5.

Zero Spread ACCOUNT

- Zero Spread account’s primary component is no spread. Trading with zero spread will allow you to build your benefit and make a more exact estimate on your incomes. Albeit this kind of account doesn’t need any spread, it charges a commission of $20 per part.

- The Zero Spread account is ideal for those traders who lean toward high velocity trading. It presents traders the influence to 1:3000 and 200 open positions and forthcoming orders greatest. Go ahead and make your trading venture significantly more effective with our 100 percent Deposit Bonus and Level Up Bonus.

- The Zero Spread account upholds the accompanying trading instruments: Forex, metals, and Forex intriguing. At FBS, the Zero Spread account is accessible on MetaTrader 4.

ECN ACCOUNT

- ECN (Electronic Communication Network) account is a decision of expert traders who need the most ideal trading conditions.

- The ECN account permits purchasers and dealers to exchange straightforwardly with next to no brokers. To open the ECN account, you really want to put aside an underlying installment of $1000. Not modest but rather worth the effort!

- The primary advantages of the ECN account are the quickest market execution, low spreads (from – 1 pip), best statements with no deferral, and an enormous number of liquidity suppliers. Bid farewell to all as far as possible and have a perpetual number of open positions and forthcoming orders.

- The spread on the ECN account is super cutthroat, consequently FBS requires a commission of $6.

The ECN account offers 25 cash sets for trading.

Crypto ACCOUNT

-

The Crypto account is an ideal choice to attempt the world’s freshest and most interesting resource class – digital forms of money. Bitcoin, Ethereum, and other computerized coins are exceptionally unpredictable, so traders can benefit from fast value developments. Additionally, in contrast to conventional business sectors, crypto trading is accessible every minute of every day.

The Crypto account upholds in excess of 100 instruments: coins, coin-fiat, coin-coin, coin-metals.

FBS offers brilliant terms for trading advanced resources: low spreads, fixed influence 1:5, and simple stores and withdrawals in fiat and crypto. You can likewise begin with a Demo Crypto account to take a stab at trading with next to no danger. Crypto account is accessible on MetaTrader 5 as it were

FBS offers you a wide range of trading instruments: Forex, metals, indices, energies, Forex exotic, stocks, and even cryptocurrencies. The availability of assets depends on the type of account you choose. View the Standard versus Raw Spread correlation table to track down the right account for your requirements.

Islamic Account Option

Forex Islamic accounts are great for Muslim customers as they line up with the Islamic confidence and bring about no trades or premium charges on for the time being positions. FBS make trading agreeable and equivalent for everybody, so we offer our traders a Swap Free choice on Cent and Standard accounts, making your trading revenue free.

What are FBS’ spread costs on an Islamic Account?

This will depend on the type of account that traders convert to an Islamic Account. The spreads that trades can expect include:

- Standard account – form 0.5 pips.

- Cent account – from 1 pip.

- Micro account – from 3 pips.

- Zero Spread – from 0.0 pips.

FBS Broker Spreads

FBS gives an adaptable and cutthroat spread rundown where spreads are either fixed or drifting, shifting across the account types advertised. The commissions that traders can expect are simply applied to two account types. These spreads and commissions, according to each account type, are as per the following:

To diminish your trading costs and amplify benefit, exchange with restricted spreads given by FBS organization.

FBS provides the following types of spread:

Floating, starting from 0.2 pip;

Fixed, starting from 3 pip;

Trading without spread (fixed spread of 0 pip).

Spread type and value are determined by the account type.

FBS Trading Platforms

FBS Broker offer the three most well known forex trading platforms around the world.

Utilize the most helpful, useful and dependable trading platforms!

Benefit with state-of-the-art devices that assist you with trading proficiently, and plan your techniques with the assistance of various scientific examples. Versatile adaptations of the items furnish you with a trading experience readily available. You progress as a trader anyplace whenever.

FBS Trader: A Powerful Trading Platform in a Mobile Format.

Innovative Trading Platform,Secure, fast, and outstanding — a mobile trading platform created by FBS.

Always in touch with traders, FBS understands their needs. That is why the broker created a secure and innovative trading application. Explore unlimited opportunities of active trading on the go with FBS Trader.

FBS MT4 :FBS offers MetaTrader 4 for Windows and Mac as well as for Android and iOS mobile platforms. MT4 provides a trading experience at your fingertips allowing you to progress as a trader anywhere at anytime.

FBS MT5: Having its predecessor’s best practice at hand, MetaTrader 5 is a more versatile software. It offers a wider choice of analytical tools, a possibility to trade stocks and commodities apart from currencies, and additional timeframes.

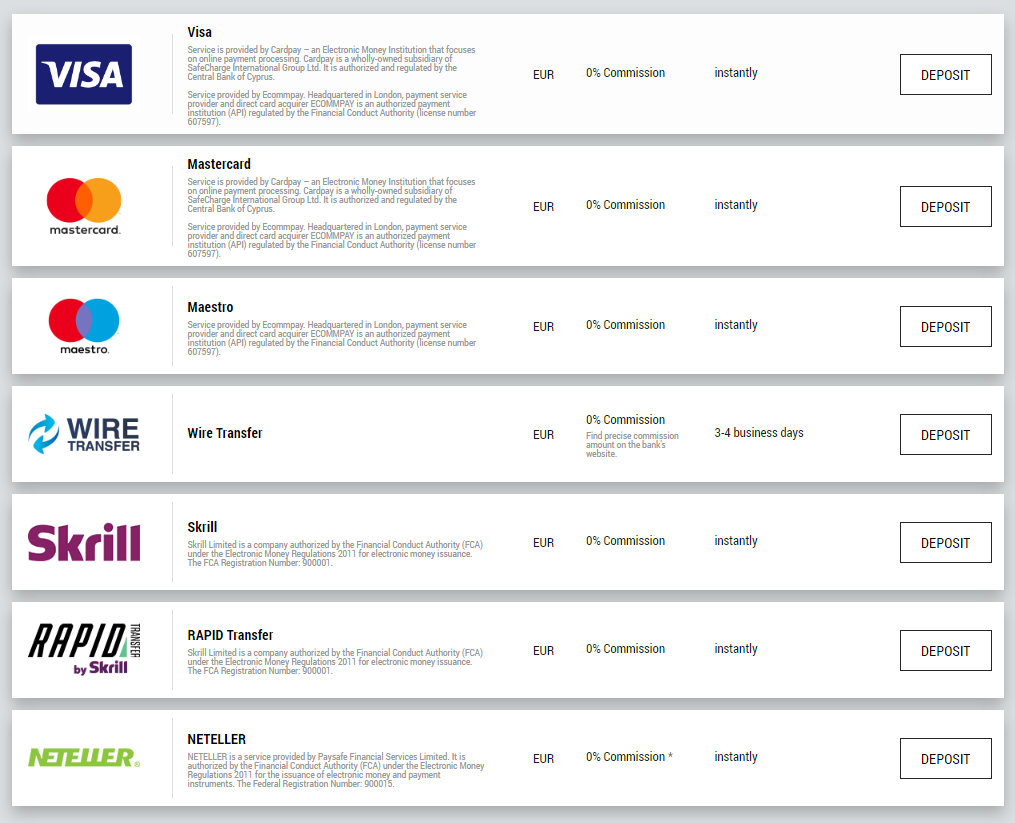

Account Funding

FBS offers different funding methods, including numerous electronic payment systems, credit and debit cards, bank wire transfers, and exchangers. There are no deposit fees or commissions charged by FBS for any deposits into the trading accounts.

Deposits via electronic payment systems are processed instantly. Deposit requests via other payment systems are processed within 1-2 hours during FBS Financial dept.

FBS Financial department works 24/7. The maximum time of processing a deposit/withdrawal request via an electronic payment system is 48 hours since the moment of its creation. Bank wire transfers take up to 5-7 bank business days to process.

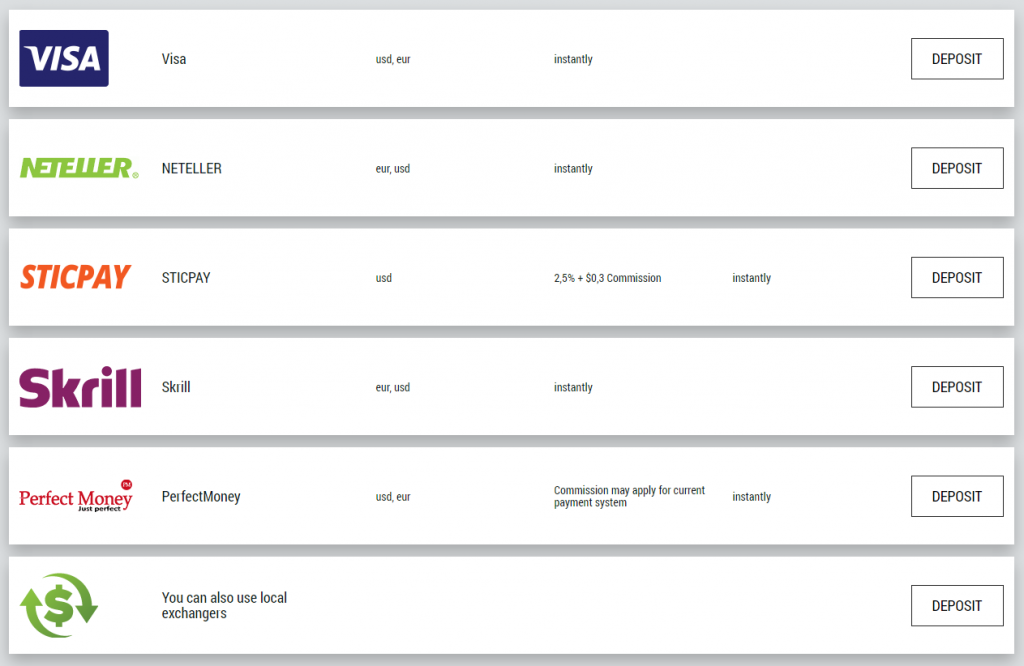

FBS Broker Withdrawals

FBS charges both store expenses and withdrawal charges as indicated by the installment technique that the trader picks. Store expenses of 2.5% in addition to $0.3 commissions are charged when utilizing STICPAY and there are commissions that apply when utilizing Perfect Money, albeit the sums are not demonstrated.

Traders can hope to pay the accompanying withdrawal charges:

Credit/Debit Card – $1 commission.

Neteller – 2%, $1 least, and a limit of $30.

STICPAY – 2.5% in addition to $0.3 commission.

Skrill – 1$ in addition to $0.32 commission.

Perfect Money – 0.50% commission.

There could be no other agent charges demonstrated for FBS, for example, latency expenses or money transformation charges. Be that as it may, traders are asked to check the presence of such expenses with FBS before they register for a live trading account.

Regulation

FBS Broker is authorised and regulated by the IFSC, FSCA (south africa), ASIC, CySEC

IFSC

FBS Markets Inc is regulated by IFSC, license IFSC/000102/198; Address: 2118, Guava Street, Belize Belama Phase 1, Belize

FSCA

One more great achievement – FBS is now licensed by the Australian Securities and Investment Commission (ASIC) and the Financial Sector Conduct Authority (FSCA).

ASIC

From now on, Australian clients can join in and enjoy all the perks of being with FBS under the Australian Financial Services License and ASIC regulation. With this new licence, FBS launches a new website for Australian traders and those who want to trade under Australian law. You can find the Australian version of the FBS website at www.fbsaustralia.com.

CySEC

FBS is now licensed BY the Cyprus Securities and Exchange Commission (CySEC) under license number 331/17.

3,716 Comments

My Site

Check my blog

Cheap cialis https://canadianpharmaceuticalsonline.home.blog/

Cheers, I like it!

cialis online https://reallygoodemails.com/onlineviagra

Lovely content. Many thanks!

Viagra daily https://viagraonline.estranky.sk/clanky/viagra-without-prescription.html

Nicely put. Thanks a lot!

Viagra pills https://viagraonlineee.wordpress.com/

Nicely put. Thanks a lot.

Viagra 20 mg https://viagraonline.home.blog/

Whoa a good deal of awesome knowledge!

cialis 5mg https://viagraonlinee.livejournal.com/492.html

Thank you! Terrific information!

Viagra 5 mg funziona https://onlineviagra.flazio.com/

Amazing loads of fantastic info.

cialis online https://onlineviagra.fo.team/

Good write ups, Kudos.

tadalafil generic https://www.kadenze.com/users/canadian-pharmaceuticals-for-usa-sales

Thank you. A good amount of material.

purchasing cialis on the internet https://linktr.ee/canadianpharmaceuticalsonline

Nicely put. With thanks.

canadian pharmacies that ship to us https://disqus.com/home/forum/canadian-pharmaceuticals-online/

Valuable knowledge. Thank you.

cialis tablets australia https://500px.com/p/canadianpharmaceuticalsonline

You definitely made the point.

cialis prices https://dailygram.com/index.php/blog/1155353/we-know-quite-a-bit-about-covid-19/

Many thanks. I appreciate this!

best canadian pharmacy https://challonge.com/en/canadianpharmaceuticalsonlinemt

Awesome forum posts. Many thanks.

purchasing cialis on the internet https://500px.com/p/listofcanadianpharmaceuticalsonline

Thank you. Numerous posts.

canadian pharmacy online 24 https://www.seje.gov.mz/question/canadian-pharmacies-shipping-to-usa/

You actually said it adequately!

cialis canadian pharmacy https://challonge.com/en/canadianpharmaciesshippingtousa

You have made your point pretty effectively!.

tadalafil generic https://challonge.com/en/canadianpharmaceuticalsonlinetousa

Regards! Fantastic stuff.

canadian pharmacycanadian pharmacy https://pinshape.com/users/2441403-canadian-pharmaceuticals-online

Position clearly used..

online canadian pharmacies https://www.scoop.it/topic/canadian-pharmaceuticals-online

You said it adequately.!

buy cialis online https://reallygoodemails.com/canadianpharmaceuticalsonline

Fantastic data. With thanks.

generic for cialis pinshape.com/users/2441621-canadian-pharmaceutical-companies

Thanks, A good amount of posts.

canadian cialis https://pinshape.com/users/2441621-canadian-pharmaceutical-companies

Cheers, A good amount of data.

canadian pharmacies shipping to usa https://reallygoodemails.com/canadianpharmaceuticalcompanies

With thanks, Very good information.

dosage for stromectol https://pinshape.com/users/2445987-order-stromectol-over-the-counter

You actually mentioned this really well!

Viagra generika https://reallygoodemails.com/orderstromectoloverthecounter

Factor effectively applied!!

5 mg viagra coupon printable https://challonge.com/en/orderstromectoloverthecounter

Great facts. With thanks!

buy stromectol online fitndance https://500px.com/p/orderstromectoloverthecounter

Nicely put. Cheers!

Tadalafil tablets https://www.seje.gov.mz/question/order-stromectol-over-the-counter-6/

You actually mentioned it terrifically!

stromectol for sale online https://canadajobscenter.com/author/buystromectol/

You actually said this adequately!

buy viagra online usa https://canadajobscenter.com/author/canadianpharmaceuticalsonline/

Cheers. Ample advice.

prescriptions from canada without https://aoc.stamford.edu/profile/canadianpharmaceuticalsonline/

Effectively spoken certainly. !

Viagra 5 mg https://canadianpharmaceuticalsonline.bandcamp.com/releases

Nicely put, Kudos.

cialis from canada https://ktqt.ftu.edu.vn/en/question list/canadian-pharmaceuticals-for-usa-sales/

Kudos, Valuable stuff!

Viagra great britain https://www.provenexpert.com/canadian-pharmaceuticals-online/

Wow quite a lot of excellent advice!

Cheap viagra https://aoc.stamford.edu/profile/Stromectol/

You said it adequately.!

stromectol for scabies https://ktqt.ftu.edu.vn/en/question list/order-stromectol-over-the-counter-10/

Cheers, Lots of data.

Viagra manufacturer coupon https://orderstromectoloverthecounter.bandcamp.com/releases

Thanks. I like it!

Viagra rezeptfrei https://www.provenexpert.com/order-stromectol-over-the-counter12/

Really loads of fantastic advice.

Online viagra https://www.repairanswers.net/question/order-stromectol-over-the-counter-2/

Nicely put. Thank you!

Canadian viagra https://www.repairanswers.net/question/stromectol-order-online/

You reported it very well.

stromectol espana https://canadajobscenter.com/author/arpreparof1989/

You actually explained it well!

Viagra prices https://aoc.stamford.edu/profile/goatunmantmen/

Cheers, Lots of facts.

Viagra purchasing https://web904.com/stromectol-buy/

Superb content. Appreciate it.

Viagra generic https://web904.com/buy-ivermectin-online-fitndance/

Nicely spoken of course! .

order stromectol over the counter https://glycvimepedd.bandcamp.com/releases

Thanks! Awesome information.

How does viagra work https://canadajobscenter.com/author/ereswasint/

Amazing posts, Kudos!

Buy viagra https://aoc.stamford.edu/profile/hispennbackwin/

Info effectively utilized..

Viagra prices https://bursuppsligme.bandcamp.com/releases

Regards. Numerous stuff!

Generic for viagra https://pinshape.com/users/2461310-canadian-pharmacies-shipping-to-usa

This is nicely put! .

Viagra daily https://pinshape.com/users/2462760-order-stromectol-over-the-counter

Regards, Numerous write ups!

Viagra from canada https://pinshape.com/users/2462910-order-stromectol-online

With thanks, Loads of information!

Viagra kaufen 500px.com/p/phraspilliti

Nicely put. Thank you.

Viagra reviews https://web904.com/canadian-pharmaceuticals-for-usa-sales/

Nicely put, Regards.

Viagra generika https://500px.com/p/skulogovid/?view=groups

You actually stated this fantastically!

Viagra generique https://500px.com/p/bersavahi/?view=groups

Regards! Lots of content!

top rated online canadian pharmacies https://reallygoodemails.com/canadianpharmaceuticalsonlineusa

Great information. Thank you!

Viagra tablets australia https://www.provenexpert.com/canadian-pharmaceuticals-online-usa/

Great stuff. Thanks a lot.

Low cost viagra 20mg https://sanangelolive.com/members/pharmaceuticals

You actually suggested it superbly.

Cheap viagra https://melaninterest.com/user/canadian-pharmaceuticals-online/?view=likes

Nicely put. Many thanks.

cialis from canada https://haikudeck.com/canadian-pharmaceuticals-online-personal-presentation-827506e003

You expressed it terrifically!

How does viagra work https://buyersguide.americanbar.org/profile/420642/0

Superb posts. Regards.

Viagra great britain https://experiment.com/users/canadianpharmacy

Tips nicely taken!!

pharmacy canada https://slides.com/canadianpharmaceuticalsonline

You’ve made your point quite nicely!.

Viagra tablets australia https://challonge.com/esapenti

Awesome posts, Thanks!

Viagra prices https://challonge.com/gotsembpertvil

Superb knowledge. Many thanks!

Canadian viagra https://challonge.com/citlitigolf

This is nicely put. !

Viagra purchasing https://order-stromectol-over-the-counter.estranky.cz/clanky/order-stromectol-over-the-counter.html

Whoa quite a lot of helpful tips!

Viagra cost https://soncheebarxu.estranky.cz/clanky/stromectol-for-head-lice.html

This is nicely put. !

Viagra 5 mg https://lehyriwor.estranky.sk/clanky/stromectol-cream.html

Incredible lots of terrific advice!

Viagra tablets https://dsdgbvda.zombeek.cz/

You made your point.

stromectol tablets https://inflavnena.zombeek.cz/

Nicely put, Thanks a lot.

Tadalafil https://www.myscrsdirectory.com/profile/421708/0

You stated this effectively!

Viagra 5mg prix https://supplier.ihrsa.org/profile/421717/0

Great posts. Regards!

Low cost viagra 20mg https://wefbuyersguide.wef.org/profile/421914/0

Cheers. I enjoy this.

Viagra generico https://legalmarketplace.alanet.org/profile/421920/0

You explained that well.

Viagra vs viagra https://moaamein.nacda.com/profile/422018/0

Incredible all kinds of terrific facts!

canada medication https://www.audiologysolutionsnetwork.org/profile/422019/0

You actually stated that fantastically.

discount canadian pharmacies https://network.myscrs.org/profile/422020/0

Thanks a lot. Ample advice.

Viagra 5 mg https://sanangelolive.com/members/canadianpharmaceuticalsonlineusa

Seriously many of amazing tips.

Viagra 20mg https://sanangelolive.com/members/girsagerea

Incredible a lot of very good info!

canadian pharmacys https://www.ecosia.org/search?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Amazing content, Regards!

Tadalafil tablets https://www.mojomarketplace.com/user/Canadianpharmaceuticalsonline-EkugcJDMYH

Awesome write ups, Thanks!

Viagra lowest price https://seedandspark.com/user/canadian-pharmaceuticals-online

Many thanks! An abundance of postings!

canadian pharmacy uk delivery https://www.giantbomb.com/profile/canadapharmacy/blog/canadian-pharmaceuticals-online/265652/

Nicely put. Thank you.

Viagra dosage https://feeds.feedburner.com/bing/Canadian-pharmaceuticals-online

Thank you. I enjoy this.

no 1 canadian pharcharmy online https://search.gmx.com/web/result?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

You said it adequately!

Viagra 5 mg funziona https://search.seznam.cz/?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Thank you. Quite a lot of write ups.

Viagra alternative https://sanangelolive.com/members/unsafiri

You actually suggested it terrifically!

online canadian pharmacy

Seriously lots of valuable info!

Viagra tablets https://swisscows.com/en/web?query=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Thanks a lot! I value this.

Generic viagra https://www.dogpile.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Terrific posts. Many thanks.

canada pharmacies online prescriptions

With thanks! Good stuff!

online drug store https://search.givewater.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Thanks a lot. An abundance of information.

Viagra 20mg https://www.bakespace.com/members/profile/Сanadian pharmaceuticals for usa sales/1541108/

You expressed that terrifically!

Low cost viagra 20mg

Thank you. Loads of write ups.

canadian pharmaceuticals online https://results.excite.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Regards, I like it!

Viagra uk https://www.infospace.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Really a lot of very good information!

Viagra 20 mg https://headwayapp.co/canadianppharmacy-changelog

Nicely put, Appreciate it!

Canadian Pharmacies Shipping to USA https://results.excite.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Terrific data. Many thanks!

canadian pharmacy king https://canadianpharmaceuticalsonline.as.me/schedule.php

Nicely put. Appreciate it!

canadian pharmacy viagra brand https://feeds.feedburner.com/bing/stromectolnoprescription

Factor clearly used!!

top rated online canadian pharmacies https://reallygoodemails.com/orderstromectoloverthecounterusa

Regards! Lots of information.

stromectol brasilien https://aoc.stamford.edu/profile/cliclecnotes/

Lovely info, Many thanks.

stromectol scabies https://pinshape.com/users/2491694-buy-stromectol-fitndance

With thanks. I appreciate it!

Viagra tablets https://www.provenexpert.com/medicament-stromectol/

With thanks. Ample knowledge.

Viagra generico online https://challonge.com/bunmiconglours

You actually suggested that fantastically!

Tadalafil 20 mg https://theosipostmouths.estranky.cz/clanky/stromectol-biam.html

Regards. Very good stuff.

buy ivermectin https://tropkefacon.estranky.sk/clanky/buy-ivermectin-fitndance.html

Thanks. Awesome information.

canadian pharmacy https://www.midi.org/forum/profile/89266-canadianpharmaceuticalsonline

Many thanks, I appreciate it.

Viagra reviews https://dramamhinca.zombeek.cz/

Lovely posts, Regards!

Viagra generique https://sanangelolive.com/members/thisphophehand

Amazing posts. Thanks!

Cheap viagra https://motocom.co/demos/netw5/askme/question/canadian-pharmaceuticals-online-5/

Wonderful content. With thanks!

prescription drugs without prior prescription https://www.infospace.com/serp?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Cheers! Lots of forum posts!

Viagra generico online https://zencastr.com/@pharmaceuticals

Thanks a lot. Terrific information!

Buy generic viagra https://aleserme.estranky.sk/clanky/stromectol-espana.html

Very well expressed of course! !

How does viagra work https://orderstromectoloverthecounter.mystrikingly.com/

Info effectively taken.!

Viagra great britain https://stromectoloverthecounter.wordpress.com/

Thanks a lot! Loads of facts!

Generic for viagra https://buystromectol.livejournal.com/421.html

Incredible a lot of helpful information.

5 mg viagra coupon printable https://orderstromectoloverthecounter.flazio.com/

You actually mentioned that perfectly!

Viagra kaufen https://search.lycos.com/web/?q=“My Canadian Pharmacy – Extensive Assortment of Medications – 2022”

Seriously lots of good info.

Viagra generique https://conifer.rhizome.org/pharmaceuticals

Incredible a lot of terrific information.

Viagra or viagra https://telegra.ph/Order-Stromectol-over-the-counter-10-29

Incredible many of great tips!

stromectol price https://graph.org/Order-Stromectol-over-the-counter-10-29-2

Position certainly considered!!

buy stromectol scabies online https://orderstromectoloverthecounter.fo.team/

Beneficial data. With thanks!

stromectol cvs https://orderstromectoloverthecounter.proweb.cz/

Many thanks. Valuable information.

Viagra reviews https://orderstromectoloverthecounter.nethouse.ru/

Nicely put. Kudos!

canadian pharmacies online prescriptions https://sandbox.zenodo.org/communities/canadianpharmaceuticalsonline/

Thank you, Quite a lot of data.

canada pharmacies online https://demo.socialengine.com/blogs/2403/1227/canadian-pharmaceuticals-online

Wow a lot of amazing information.

canadian rx https://pharmaceuticals.cgsociety.org/jvcc/canadian-pharmaceuti

Very good posts. Appreciate it!

canadian pharmacy king https://taylorhicks.ning.com/photo/albums/best-canadian-pharmaceuticals-online

You expressed that fantastically.

global pharmacy canada https://my.afcpe.org/forums/discussion/discussions/reputable-canadian-pharmaceuticals-online

Superb forum posts. Many thanks.

online pharmacy https://www.dibiz.com/ndeapq

Reliable facts. Thanks!

Viagra daily https://www.podcasts.com/canadian-pharmacies-shipping-to-usa

Wow plenty of helpful tips.

best canadian pharmacies online https://canadianpharmaceuticals.educatorpages.com/pages/canadian-pharmacies-shipping-to-usa

Many thanks! I appreciate this!

Viagra 5 mg funziona https://soundcloud.com/canadian-pharmacy

Amazing a lot of terrific advice.

Buy viagra online https://peatix.com/user/14373921/view

Cheers. Valuable stuff.

canada pharmacies online prescriptions https://www.cakeresume.com/me/best-canadian-pharmaceuticals-online

You made your point!

prescription drugs without prior prescription https://dragonballwiki.net/forum/canadian-pharmaceuticals-online-safe/

Amazing posts. Appreciate it!

Viagra vs viagra https://the-dots.com/projects/covid-19-in-seven-little-words-848643

With thanks! I enjoy this!

Viagra canada https://jemi.so/canadian-pharmacies-shipping-to-usa

You expressed it effectively!

canadian pharmacy king https://www.homify.com/ideabooks/9099923/reputable-canadian-pharmaceuticals-online

This is nicely put! !

Viagra lowest price https://medium.com/@pharmaceuticalsonline/canadian-pharmaceutical-drugstore-2503e21730a5

Beneficial tips. Kudos.

Viagra vs viagra https://infogram.com/canadian-pharmacies-shipping-to-usa-1h1749v1jry1q6z

Amazing forum posts. Thanks.

Tadalafil tablets https://pinshape.com/users/2507399-best-canadian-pharmaceuticals-online

Really plenty of beneficial information!

Viagra vs viagra https://aoc.stamford.edu/profile/upogunem/

Many thanks! I value this.

viagra canada https://500px.com/p/maybenseiprep/?view=groups

Wow a lot of wonderful data.

Buy viagra online https://challonge.com/ebtortety

You’ve made your position pretty clearly.!

Viagra 5mg prix https://sacajegi.estranky.cz/clanky/online-medicine-shopping.html

Very well spoken indeed. !

Viagra or viagra https://speedopoflet.estranky.sk/clanky/international-pharmacy.html

Regards. Loads of material.

canada drugs https://dustpontisrhos.zombeek.cz/

You explained it superbly.

list of reputable canadian pharmacies https://sanangelolive.com/members/maiworkgendty

Nicely put, Thanks!

canada online pharmacy https://issuu.com/lustgavalar

Kudos, Great information.

canadian pharmacy viagra brand https://calendly.com/canadianpharmaceuticalsonline/onlinepharmacy

Information effectively applied..

Viagra cost https://aoc.stamford.edu/profile/uxertodo/

Helpful advice. Thank you.

Viagra 20 mg https://www.wattpad.com/user/Canadianpharmacy

Thanks. Wonderful information!

highest rated canadian pharmacies https://pinshape.com/users/2510246-medicine-online-shopping

Regards! Useful information!

Viagra bula https://500px.com/p/reisupvertketk/?view=groups

Amazing many of beneficial info!

Viagra tablets australia https://www.provenexpert.com/online-order-medicine/

You revealed it exceptionally well.

Viagra 5mg prix https://challonge.com/ebocivid

Incredible lots of beneficial data!

Viagra daily https://obsusilli.zombeek.cz/

Useful posts. Many thanks.

canadian pharmacy meds https://sanangelolive.com/members/contikegel

Great postings, Thanks a lot.

canadianpharmacy https://rentry.co/canadianpharmaceuticalsonline

Superb postings. Regards!

Viagra uk https://tawk.to/canadianpharmaceuticalsonline

You have made your point.

canadian rx world pharmacy https://canadianpharmaceuticalsonline.tawk.help/article/canadian-pharmacies-shipping-to-usa

Really a lot of very good data.

Viagra generico https://sway.office.com/bwqoJDkPTZku0kFA

You reported that fantastically.

Viagra online https://canadianpharmaceuticalsonline.eventsmart.com/2022/11/20/canadian-pharmaceuticals-for-usa-sales/

Truly many of superb advice!

Online viagra https://suppdentcanchurch.estranky.cz/clanky/online-medicine-order-discount.html

Nicely put, Thanks.

Viagra from canada https://aoc.stamford.edu/profile/tosenbenlren/

Wow many of terrific material.

Viagra for daily use https://pinshape.com/users/2513487-online-medicine-shopping

Thanks a lot. Ample data.

Viagra 5mg https://500px.com/p/meyvancohurt/?view=groups

Useful write ups. Thank you.

Low cost viagra 20mg https://www.provenexpert.com/pharmacy-online/

Nicely put. Thank you.

canada drug pharmacy https://challonge.com/townsiglutep

Many thanks! Excellent stuff!

Viagra dosage https://appieloku.estranky.cz/clanky/online-medicine-to-buy.html

Seriously tons of great info.

Viagra uk https://scisevitrid.estranky.sk/clanky/canada-pharmacies.html

You said it perfectly.!

Viagra vs viagra https://brujagflysban.zombeek.cz/

Nicely put, Thanks a lot!

Interactions for viagra https://pinshape.com/users/2517016-cheap-ed-drugs

Thanks a lot. An abundance of facts!

Generic for viagra https://500px.com/p/stofovinin/?view=groups

You stated this terrifically.

Viagra 5 mg funziona https://challonge.com/afersparun

You actually expressed that superbly.

How does viagra work https://plancaticam.estranky.cz/clanky/best-drugs-for-ed.html

Nicely put. Regards!

Buy viagra https://piesapalbe.estranky.sk/clanky/buy-erectile-dysfunction-medications-online.html

Wow lots of beneficial knowledge.

Viagra kaufen https://wallsawadar.zombeek.cz/

Good info. Cheers.

trust pharmacy canada https://www.cakeresume.com/me/canadian-pharmaceuticals-online/

Many thanks. Good information!

Buy viagra https://canadianpharmaceuticalsonline.studio.site/

Wonderful data, Thank you.

Tadalafil 5mg https://en.gravatar.com/canadianpharmaceuticalcompanies

Whoa plenty of excellent advice!

Viagra rezeptfrei https://www.viki.com/users/pharmaceuticalsonline/about

Amazing all kinds of useful information.

Interactions for viagra https://canadianpharmaceuticalsonline.blog.jp/archives/19372004.html

Terrific write ups, Appreciate it.

Viagra lowest price https://canadianpharmaceuticalsonline.doorblog.jp/archives/19385382.html

Seriously all kinds of great facts!

pharmacy https://canadianpharmaceuticalsonline.ldblog.jp/archives/19386301.html

Regards. A good amount of advice!

Buy viagra https://canadianpharmaceuticalsonline.dreamlog.jp/archives/19387310.html

Thank you, Lots of data!

Viagra 20 mg https://canadianpharmaceuticalsonline.publog.jp/archives/16846649.html

With thanks, Lots of write ups.

Generic for viagra https://canadianpharmaceuticalsonline.livedoor.biz/archives/17957096.html

Awesome posts, Many thanks!

5 mg viagra coupon printable https://canadianpharmaceuticalsonline.diary.to/archives/16857199.html

Nicely put. With thanks!

canadian rx world pharmacy https://canadianpharmaceuticalsonline.weblog.to/archives/19410199.html

Helpful write ups. Kudos!

Viagra tablets https://canadianpharmaceuticalsonline.bloggeek.jp/archives/16871680.html

Seriously many of excellent information.

Generic viagra https://canadianpharmaceuticalsonline.blogism.jp/archives/17866152.html

Many thanks, Great stuff.

Generic for viagra https://canadianpharmaceuticalsonline.blogo.jp/archives/19436771.html

Seriously a lot of amazing advice!

Viagra from canada https://canadianpharmaceuticalsonline.blogto.jp/archives/19498043.html

Kudos, Quite a lot of tips.

Viagra for sale https://canadianpharmaceuticalsonline.gger.jp/archives/18015248.html

Terrific forum posts. Thanks a lot!

Viagra levitra https://canadianpharmaceuticalsonline.golog.jp/archives/16914921.html

Amazing content. With thanks.

Viagra or viagra https://canadianpharmaceuticalsonline.liblo.jp/archives/19549081.html

You said it adequately..

How does viagra work https://canadianpharmaceuticalsonline.myjournal.jp/archives/18054504.html

Cheers! Lots of information.

Viagra rezeptfrei https://canadianpharmaceuticalsonline.mynikki.jp/archives/16957846.html

Thanks, Ample info!

Tadalafil 20 mg https://pinshape.com/users/2528098-canadian-pharmacy-online

Wonderful knowledge. Thank you.

Interactions for viagra https://gravatar.com/kqwsh

This is nicely expressed. !

Viagra vs viagra vs levitra https://www.buymeacoffee.com/pharmaceuticals

Thanks a lot, Lots of info.

prescriptions from canada without https://telegra.ph/Canadian-pharmacy-drugs-online-12-11

Appreciate it. Lots of material!

Viagra uk https://graph.org/Canadian-pharmacies-online-12-11

Amazing many of amazing information!

Viagra 5mg https://canadianonlinepharmacieslegitimate.flazio.com/

Nicely expressed genuinely! !

Canadian viagra https://halttancentnin.livejournal.com/301.html

Amazing plenty of valuable info!

canadian pharmacycanadian pharmacy https://app.roll20.net/users/11413335/canadian-pharmaceuticals-online-shipping

You said it adequately.!

canadian pharmacy king https://linktr.ee/canadianpharmaceuticalsonlineu

Useful material. Thanks.

canadian drugstore https://onlinepharmaciesofcanada.bigcartel.com/best-canadian-online-pharmacy

You explained this perfectly.

canadian pharmacies online prescriptions https://hub.docker.com/r/canadadiscountdrug/pharmaceuticals

Wow quite a lot of very good material!

Cheap viagra https://pharmacy-online.teachable.com/

Seriously plenty of excellent material!

Viagra generico online https://experiment.com/users/canadiandrugs/

You said it very well.!

canadian pharmacy online 24 https://disqus.com/by/canadiandrugspharmacy/about/

Thanks, A lot of facts.

best canadian pharmacies online https://offcourse.co/users/profile/best-online-canadian-pharmacy

Fantastic data. Appreciate it!

Viagra tablets https://bitcoinblack.net/community/canadianpharmacyonlineviagra/info/

Very well spoken of course. !

canadian prescription drugstore https://forum.melanoma.org/user/canadadrugsonline/profile/

Seriously a lot of helpful info.

Canadian viagra https://wakelet.com/@OnlinepharmacyCanadausa

Truly tons of wonderful facts.

Viagra 5 mg https://www.divephotoguide.com/user/canadadrugspharmacyonline

With thanks, I value it.

buy viagra usa http://canadianpharmaceuticalsonlinee.iwopop.com/

With thanks. I value it.

Viagra uk https://datastudio.google.com/reporting/1e2ea892-3f18-4459-932e-6fcd458f5505/page/MCR7C

With thanks. Very good information.

Interactions for viagra https://pharmacycheapnoprescription.nethouse.ru/

Really a good deal of awesome knowledge!

Cheap viagra https://www.midi.org/forum/profile/96944-pharmacyonlinecheap

You said it nicely.!

Viagra vs viagra vs levitra https://www.provenexpert.com/canadian-pharmacy-viagra-generic2/

Very well voiced of course. .

Viagra coupon https://dailygram.com/blog/1183360/canada-online-pharmacies/

You mentioned that superbly!

Viagra great britain https://www.goodreads.com/user/show/161146330-canadianpharmaceuticalsonline

Seriously tons of useful facts.

Viagra sans ordonnance https://myanimelist.net/profile/canadapharmacies

Valuable info. Regards.

Viagra 5mg https://pharmacyonlineprescription.webflow.io/

Fantastic stuff. Thanks.

canadian pharmacy cialis https://www.isixsigma.com/members/pharmacyonlinenoprescription/

Thanks! Great information.

canada drug pharmacy https://slides.com/bestcanadianonlinepharmacies

Wow lots of excellent facts.

Viagra rezeptfrei https://www.mojomarketplace.com/user/discountcanadiandrugs-f0IpYCKav8

You actually reported it perfectly.

FBS offers a wide range of tradable assets and competitive spreads, making it a great choice for traders.

The execution speed on FBS is very fast, which is crucial for successful trades.

I’ve had a great experience trading with FBS and highly recommend them to anyone looking for a reliable and professional broker.

FBS has a great reputation in the industry and it’s easy to see why after trading with them for a while.

I’ve found FBS’ customer support to be very knowledgeable and helpful.

FBS is a great choice for traders looking for competitive spreads and a wide range of tradable assets.

I’ve found FBS to be a reliable and trustworthy broker for my trading needs.

canadian pharmacy https://canadianpharmaceuticalsonlinee.bandcamp.com/track/canadian-pharmaceuticals-usa

You expressed that terrifically!

Viagra 5mg https://www.askclassifieds.com/listing/aarp-recommended-canadian-pharmacies/

This is nicely said. .

Canadian viagra https://www.gamespace.com/members/canadianprescriptionsonline/

Regards! Plenty of content.

Viagra alternative https://haikudeck.com/presentations/canadianpharmacies

You reported that superbly.

top rated online canadian pharmacies https://www.bakespace.com/members/profile/Viagra generic online Pharmacy/1562809/

Wonderful facts. Many thanks.

canadian prescription drugstore https://conifer.rhizome.org/Discountpharmacy

You actually reported that very well.

Buy generic viagra https://haikudeck.com/presentations/cheapprescriptiondrugs

You actually mentioned it very well.

Viagra levitra https://experiment.com/users/pviagrapharmacy100mg

Superb data. Thank you!

Viagra levitra https://slides.com/canadianpharmacycialis20mg

Really tons of terrific knowledge!

canadian pharcharmy online https://www.mojomarketplace.com/user/genericviagraonline-A1mET2hm7S

Wow plenty of amazing facts.

Viagra 5 mg https://seedandspark.com/user/buy-viagra-pharmacy-100mg/

You explained it well.

canadian pharmacy uk delivery https://www.giantbomb.com/profile/reatticamic/blog/canadian-government-approved-pharmacies/268967/

You actually mentioned it fantastically.

Tadalafil tablets https://www.bakespace.com/members/profile/Canadian drugs online pharmacies/1563583/

Kudos, A good amount of stuff!

canadian pharmacies https://www.midi.org/forum/profile/100747-canadian-drugs-pharmacies-online

Regards. I value it.

Tadalafil 5mg https://sandbox.zenodo.org/communities/cialisgenericpharmacyonline/about/

Appreciate it! A good amount of material!

canadian government approved pharmacies https://cialispharmacy.cgsociety.org/profile

Incredible quite a lot of amazing material.

Viagra 20 mg best price https://fnote.net/notes/7ce1ce

Regards. Ample material.

Viagra dosage https://taylorhicks.ning.com/photo/albums/pharmacies-shipping-to-usa

This is nicely put. !

canadian pharmacy https://my.afcpe.org/forums/discussion/discussions/canadian-pharmacy-drugs-online

Whoa plenty of superb facts!

Viagra or viagra https://www.brit.co/u/canadian-pharmacydrugs-online

Cheers, Very good information.

canada pharmacies online prescriptions https://www.dibiz.com/gdooc

You mentioned that well!

Viagra great britain https://www.podcasts.com/canadian-pharmacy-online

Kudos! Good stuff.

Tadalafil 20 mg https://the-dots.com/projects/drugstore-online-shopping-889086/

Terrific facts. Many thanks.

canadian pharmacy https://www.passivehousecanada.com/members/canada-pharmaceuticals-online-generic/

You have made the point.

Viagra rezeptfrei https://jemi.so/generic-viagra-online-pharmacy

You actually revealed this terrifically!

Viagra uk https://www.homify.com/ideabooks/9295471/canadian-pharmacy-drugs-online

Thanks a lot. Quite a lot of data!

Viagra generique http://climbingcoaches.co.uk/member-home/londondrugscanada/profile/

Nicely put. Regards!

Viagra sans ordonnance https://infogram.com/canadian-pharmaceuticals-online-safe-1h7g6k0gqxz7o2o?live

Perfectly voiced genuinely. .

Viagra tablets https://forum.melanoma.org/user/canadianpharmacyonline/profile/

Nicely put. Thanks.

Viagra online https://www.buymeacoffee.com/pharmacies

Thanks a lot, Wonderful stuff!

Viagra 20mg https://www.brit.co/u/canadian-online-pharmaciesprescription-drugs

Well voiced truly! .

online drug store https://www.passivehousecanada.com/members/online-drugs-without-prescriptions-canada/

Fine material. Cheers!

Viagra reviews https://www.cakeresume.com/me/online-drugs-without-prescriptions-canada

This is nicely said. !

canadian pharmacies without an rx https://rabbitroom.com/members/canadianpharmaceuticalsonlinewithnoprescription/profile/

Amazing info. Thanks.

canada pharmacy online http://www.celtras.uniport.edu.ng/profile/canadianpharmacy/

Lovely content, Thank you.

canadian pharmacys https://amarutalent.edu.pe/forums/users/viagra-generic-canadian-pharmacy/

Thanks, A lot of write ups!

Cheap viagra https://offcourse.co/users/profile/pharmacy-cheap-no-prescription

You reported it fantastically.

cialis from canada https://bitcoinblack.net/community/prescription-drugs-from-canada/info/

Fantastic content, Kudos!

canadian viagra https://www.nzrelo.com/forums/users/canadianviagragenericpharmacy/

Kudos, Ample information!

online pharmacy canada https://www.beastsofwar.com/forums/users/canadiancialis/

Nicely put. With thanks.

canada pharmacy online https://www.windsurf.co.uk/forums/users/canadian-pharmacy-viagra-generic

You actually expressed that really well!

best canadian pharmacies online http://www.mjyoung.net/weblog/forums/users/canada-online-pharmacies/

Awesome postings. Thanks!

Viagra 20mg https://solorider.com/forums/users/canadian-pharmaceuticals/

Truly all kinds of awesome tips.

canada rx https://www.viki.com/users/canadianpharmaciess/about

Terrific information. Regards!

Buy viagra https://www.mixcloud.com/canadapharmacies/

Thank you, I appreciate this!

canada pharmacy http://climbingcoaches.co.uk/member-home/canadianpharmacies/profile/

Reliable facts. Many thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Deneme bonusu, bahis siteleri arasında yeni kullanıcıların ilgisini çeken önemli bir fırsattır. Deneme bonusu veren siteler, oyunculara risksiz bir şekilde platformu tanıma imkanı sunar. Peki, bu bonusların gerçekten ne gibi avantajları ve dezavantajları var? https://lorabettvhd80.shop/

The time and effort you’ve invested in this post is evident and much appreciated.

Your attention to detail and commitment to accuracy is truly commendable. Fantastic job!

The depth of research and clarity of presentation in this post is truly exceptional.

Your writing style is engaging and makes complex topics easy to understand.

I appreciate how you address both beginners and advanced readers in this post.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/tr/register?ref=MST5ZREF

I appreciate how you back up your points with solid evidence and examples.

I’m impressed by how you managed to cover all aspects of this topic so thoroughly.

Your attention to detail really shows in this well-researched article.

I appreciate how you address both beginners and advanced readers in this post.

I’m impressed by how you manage to be both comprehensive and concise at the same time.

I’ve been struggling with this concept, and your explanation finally made it click.

This post has given me a new framework for thinking about this subject. Thank you!

I appreciate how you present both sides of the argument so fairly and objectively.

This post answered many questions I had on the subject. Thank you!

Your expertise on this subject is evident in every sentence. Very impressive work!

Your attention to detail really shows in this well-researched article.

Your insights have helped me see connections I hadn’t noticed before. Very helpful!

Your insights have helped me see connections I hadn’t noticed before. Very helpful!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/en/register-person?ref=JHQQKNKN

Más de 30 años siendo bestseller y miles de grupos de apoyo inspirados https://lasmujeresqueamandemasiadopdf.cyou/ las mujeres que aman demasiado libro pdf gratis

Vegabet ile tüm maçlar her an yanınızda.

Betrust Bahiste Güvenin AdresiBahiste Güvenin Adresi

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

The romance involves a captivating enemies-to-lovers arc. Track the progression in the Fourth Wing PDF. It is satisfying to watch their relationship evolve. https://fourthwingpdf.top/ Fourth Wing

Join the discussion online after reading the A Court of Mist and Fury PDF. This book has a massive community. Download the digital copy so you can understand all the memes and theories. https://acourtofmistandfurypdf.top/ Which Book Is After A Court Of Mist And Fury

Descubre el poder liberador de decir lo que sientes con tacto, este PDF te enseña a ser honesto sin ser cruel, permitiéndote mandar a la media las situaciones falsas de forma educada y construir relaciones más auténticas. https://comomandaralamediadeformaeducadapdf.cyou/ Como Mandar A La Media De Forma Educada Frases

We offer the Lights Out PDF with a commitment to open access. Information should be free and easy to find. helping you find what you need. https://lightsoutpdf.top/ Lights Out: An Into Darkness Novel

How long have you been writing? Your articles are very good, I really like them. We should have a chance to exchange ideas sometime.www.zuqiu.online

Iron Flame fuels fantasy fires! Violet rides through romance, rebellion, revelations. Get PDF free at ironflamepdf.top instantly! https://ironflamepdf.top/ How Many Chapters In Iron Flame

Download Sunrise on the Reaping PDF free right now. Suzanne Collins masterfully reveals the emotional backstory behind Haymitch’s cynicism during the Quarter Quell. This prequel explains everything about his transformation. Get instant access without any registration barriers for dedicated fans. https://sunriseonthereapingpdf.top/ When Does Sunrise On The Reaping Come Out?

Step into the circle of magic. The An Arcane Inheritance PDF invites you in. This digital book is welcoming. Secure your copy today and become part of a community of readers who love stories about arcane inheritances. https://anarcaneinheritancepdf.top/ An Arcane Inheritance Excerpt Pdf

The In Your Dreams PDF is available for those who want to read without boundaries. It breaks down the physical limitations of books, delivering the story directly to your mind via your screen. https://inyourdreamspdf.top/ In Your Dreams File Download

Just went to peso888login. Easy enough to sign up. Now the real question: can I win something? Will report back after a few spins. Wish me luck! Login to peso888login now.

There is a wonderful feeling of abundance in an archive. An archive of romance feels like an infinite candy store. I scroll through pages of PDF titles, feeling rich with the possibility of so many unread stories waiting for me. https://anarchiveofromancepdf.top/ An Archive Of Romance Text Pdf

You can access a chronicle that makes you scream. This PDF is a record. It is a truth. The digital format is real. factual and honest. https://youcanscreampdf.top/ You Can Scream Ios Epub

JemberTourisms.com website yang memberikan informasi tentang segala sesuatu yang ada di jember termasuk wisata jember, wisata di jember, pariwisata di jember.

Immerse yourself in the intricate world of this digital book. The PDF of It Should Have Been You is complex. It should have been you navigating the plot. Download the file today and read. https://itshouldhavebeenyoupdf.top/ It Should Have Been You Scanned Copy

Experience the ease of digital reading with this top title. The PDF of It Should Have Been You is optimized. It should have been you enjoying the flow. Get the file now and start. https://itshouldhavebeenyoupdf.top/ It Should Have Been You Ending

Make your research easier with the Alcott Hall PDF. This digital file allows for keyword searching, making it simple to find specific details instantly. Download the document now and experience the efficiency of modern study tools applied to historical subjects. https://alcotthallpdf.top/ Alcott Hall Romance Novel Pdf

You can find the perfect story to make you scream. This PDF is a bestseller for a reason. It is engaging, well-written, and easy to access. Join the thousands of readers who have already downloaded their copy and started the adventure. https://youcanscreampdf.top/ You Can Scream Android Epub

Sharing book recommendations with friends is one of my favorite things to do. When I find a great archive of romance, I always tell my fellow readers. The ease of sharing a PDF file makes it simple to start a book club or just gush over the latest plot twist together. https://anarchiveofromancepdf.top/ An Archive Of Romance English Pdf

Enjoy the seamless narrative of this book on your digital device. The PDF of It Should Have Been You is ready for you. It should have been you loving this story. Secure the download now and start reading. https://itshouldhavebeenyoupdf.top/ It Should Have Been You Lynn Painter Read Online

Access Alcott Hall PDF direct. This document covers it. Our service helps. https://alcotthallpdf.top/ Alcott Hall Pdf Android

If you need a PDF that makes you scream, you can snippet this. It is a clip. The story is sound. hear and noise. https://youcanscreampdf.top/ You Can Scream Pdf With Cover

I love how accessible literature has become. An archive of romance democratizes access to reading materials. Whether you are rich or poor, if you can download a PDF, you can enjoy the same beautiful stories of love and heartbreak as everyone else. https://anarchiveofromancepdf.top/ An Archive Of Romance Electronic Book

Witness a story of survival and strength. This novel is a powerful thriller. The PDF download is fast and simple. Get the book and see how the wife deals with the shocking truth about her husband. https://myhusbandswifepdf.top/ My Husband’s Wife Book Pdf

The Anatomy of an Alibi PDF is waiting. Download file. version perfect. https://anatomyofanalibipdf.top/ Anatomy Of An Alibi Pdf Weebly

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

The Bluebird Gold PDF offers a clear path to successful gold investing. This report is filled with expert advice and detailed, reliable market information. Access this essential resource today and start making more informed and profitable financial decisions for your own bright financial future. https://bluebirdgoldpdf.site/ Bluebird Gold Epub Download

Support the shift towards digital literacy by engaging with the chosen family pdf, a format that encourages reading among tech-savvy generations who prefer screens over paper but still crave deep, meaningful content. https://chosenfamilypdf.site/ Chosen Family Pdf Android

Step into the shoes of characters who feel real. The Graceless Heart PDF brings them closer to you. It is a digital experience that rivals physical books, offering a story that is both touching and intense. https://gracelessheartpdf.site/ Graceless Heart Vk

Immerse yourself in a world of political intrigue. The Boyfriend Candidate PDF is ready for download. It is a unique setting for a romance. Download the ebook now and enjoy the backdrop of campaigns and elections. https://theboyfriendcandidatepdf.site/ The Boyfriend Candidate Epub English

perplexity pro купить ключ https://uniqueartworks.ru/perplexity-kupit.html

Face the consequences of killing off beloved characters. This novel asks “what if they came back?” The Bury Your Gays PDF explores this terrifying question, providing a digital reading experience that is as haunting as the plot itself. https://buryyourgayschucktinglepdf.site/ Chuck Tingle Horror Pdf Download

perplexity промокод купить https://uniqueartworks.ru/perplexity-kupit.html

Join the legion of “buckaroos” enjoying this mainstream hit. Chuck Tingle proves his versatility as a writer. The Bury Your Gays PDF is the most convenient way to see what the buzz is about, offering instant access to this chart-topping horror novel. https://buryyourgayschucktinglepdf.site/ Bury Your Gays Chuck Tingle Archive

Achieve metabolic freedom and say goodbye to strict dieting. This guide shows you a better way. The metabolic freedom pdf details how to eat for your metabolism, allowing you to lose weight without hunger and keep it off permanently. https://metabolicfreedom.top/ Metabolic Freedom Ben Azadi

Descubre la guía definitiva en formato PDF para poner límites sin perder la compostura, aprendiendo técnicas infalibles para alejar a personas tóxicas manteniendo siempre la elegancia y la educación, porque tu tranquilidad mental está a un clic de distancia con este manual práctico y directo. https://comomandaralamediadeformaeducadapdf.cyou/ Epub Como Mandar A La Mierda De Forma Educada

Take the step toward metabolic freedom. This guide addresses root causes. The metabolic freedom pdf explains how to build a healthy metabolism. https://metabolicfreedom.top/ Ben Azadi 30-Day Protocol Pdf

Descubre cómo la paciencia tiene un límite y cómo marcarlo, baja el manual y aprende a decir “hasta aquí” de forma educada, mandando a la media el abuso de paciencia y recuperando tu paz. https://comomandaralamediadeformaeducadapdf.cyou/ Como Mandar A La Mierda De Forma Educada, Pdf

Get the body you want with metabolic knowledge. This guide provides science. The metabolic freedom pdf explains how to create a fat-loss lifestyle. https://metabolicfreedom.top/ Metabolic Freedom Ben Azadi

Potencia tu enfoque con la teoría de Let Them. Encuentra la guía en español y el PDF completo. Las distracciones suelen venir de personas y dramas externos; al aplicar esta teoría, creas una burbuja de concentración donde tus proyectos pueden florecer sin interrupciones. https://lateorialetthem.top/ Mel Robbins Let Them Español

La esperanza de que él cambie es lo que te mantiene atrapada. Este libro mata esa falsa esperanza. Lee el formato digital y enfréntate a la verdad. Solo así podrás avanzar y encontrar a alguien que te quiera tal cual eres. https://lasmujeresqueamandemasiadopdf.cyou/ Autoayuda Mujeres Pdf

Take control of your metabolism and your weight with this informative guide. It offers practical solutions. The metabolic freedom pdf details how to reset your body’s fat-burning systems and enjoy a life of health and vitality. https://metabolicfreedom.top/ Metabolic Freedom: A 30-Day Guide To Restore Your Metabolism, Heal Hormones & Burn Fat

Si tu felicidad depende de otra persona, necesitas leer esto urgentemente. El archivo PDF de esta obra clásica te mostrará el camino hacia la autonomía. Es una inversión en tu salud mental que te permitirá construir relaciones basadas en el respeto y la igualdad. https://lasmujeresqueamandemasiadopdf.cyou/ Las Mujeres Que Aman Demasiado Descargar Pdf Gratis

Sunrise on the Reaping offers Suzanne Collins’ masterful exploration of trauma and survival in dystopian Panem through sixteen-year-old Haymitch’s journey during the fiftieth Games. This PDF prequel follows his transformation before the rebellion. Understand his broken spirit. Download free instantly without registration required. https://sunriseonthereapingpdf.top/ Where Can I Buy Sunrise On The Reaping

Optimize your study or leisure time with the Lights Out PDF available here. Our files are virus-scanned and safe for all devices. You can trust us to deliver clean, high-quality digital documents every single time you visit. https://lightsoutpdf.top/ Lights Out

Download U.S Bank routing number database in CSV format, more than 19.800 records. you can use it for everything, website etc. https://routingnumber.info/product/u-s-bank-routing-number-database/

Sunrise on the Reaping PDF uncovers the truth behind one of Panem’s most complex characters. Suzanne Collins crafts this powerful prequel about Haymitch facing the fiftieth Games. Discover his hidden strength and trauma. Free instant download available with no registration required. https://sunriseonthereapingpdf.top/ Sunrise On The Reaping Pdf Download

The Lights Out PDF is ready for instant download to your computer. secure the file and keep it safe. your personal copy is waiting. https://lightsoutpdf.top/ Are Northern Lights Out Tonight

Unveil Violet’s Iron Flame! Dragon drama delights. Download free at ironflamepdf.top! https://ironflamepdf.top/ Spicy Chapters In Iron Flame

Discover the fae realm with all its beauty and terrifying power. https://heiroffirepdf.top/ What Is The Next Book After Heir Of Fire

Ignite your reading adventure with Iron Flame PDF! Rebecca Yarros crafts a world of fierce dragons, forbidden love, and war-torn skies. Violet fights for survival in this unmissable sequel. Download free now from ironflamepdf.top – no waiting! https://ironflamepdf.top/ Iron Flame Pdf Free

Iron Flame: Fantasy firestorm unleashed! Violet navigates betrayal, bonds, and blazing skies. Unputdownable sequel. Download your PDF at ironflamepdf.top – no cost, pure thrill! https://ironflamepdf.top/ Is Iron Flame Spicy

Explore relationships that deepen and complicate in realistic ways. https://heiroffirepdf.top/ The Heir Of Fire Pdf

Iron Flame PDF pulses power! Dragon destiny dawns. Download at ironflamepdf.top! https://ironflamepdf.top/ Iron Flame Pdf Online

How Much Is The Iphone 17 Pro Going To Be When Is The Release Of Iphone 17? Apple Iphone 17 Pro Price Spain Iphone 17 Pro Max Precio Colombia Tiendas Iphone 17 Pro Max Review Pros Cons Iphone Air Price 2025 Apple Iphone Air Weight Vs Iphone 17

Uncover layers of plot twists that will keep you guessing until the very end. https://heiroffirepdf.top/ Heir Of Fire Pdf Free Download Reddit

Our site offers the Lights Out PDF with a focus on user experience. We have removed the clutter to provide a clean, fast download path. Get your file and get on with your day. https://lightsoutpdf.top/ When Did Led Lights Come Out

Learn about the psychological aspects of high-level competition. The fake skating pdf delves into the mindset required to succeed, offering strategies for focus, stress management, and overcoming performance anxiety. https://fakeskatingpdf.site/ Fake Skating Book Ending

Simplify your life with the Charlie Method. This PDF guide advocates for a minimalist approach to success. It cuts through the noise and focuses on the essential. Read the document today to learn how to declutter your mind and your schedule, making room for true achievement. https://thecharliemethodpdf.site/ The Charlie Method Android Ebook

The Charlie Method is a game-changer, and this PDF captures its essence perfectly. You will learn how to apply the principles effectively in various situations. This guide is designed for immediate implementation, ensuring you see results fast. Check out the document to uncover the secrets of this powerful methodology today. https://thecharliemethodpdf.site/ Where To Download The Charlie Method

The Shield of Sparrows PDF is the ultimate convenience. Read it in bed, on the bus, or at the park. The digital nature of the file means your book is always with you, waiting for the next chapter. https://shieldofsparrowspdf.site/ Shield Of Sparrows Pdf Google Drive

Don’t miss the chance to read this captivating story of love and war. The Check and Mate PDF is just a download away, ready to fill your free time with entertainment and inspiration. https://checkandmatepdf.site/ Chess Opening Repertoire Pdf

Download U.S Bank routing number database in CSV format, more than 19.800 records. you can use it for everything, website etc. https://routingnumber.info/product/u-s-bank-routing-number-database/

Find your rhythm in the pages of this fast-paced novel. The Check and Mate PDF is the beat, offering a story that moves with energy and purpose, keeping you engaged from start to finish. https://checkandmatepdf.site/ Chess Tactics Pdf

The Charlie Method PDF is a manual for the ambitious. It speaks the language of growth. This guide is fluent in success. Access the document today to join the conversation of high achievers and understand the dialogue of victory. https://thecharliemethodpdf.site/ The Charlie Method Reddit Review

The Shield of Sparrows PDF is a silent storyteller. It speaks to you through the screen. It whispers the tale of the sparrows. https://shieldofsparrowspdf.site/ What Is The Guardians Name In Shield Of Sparrows

Ce livre est une véritable pépite pour les amateurs de suspense et de frissons. Obtenez le fichier PDF pour découvrir une histoire de femme de ménage qui sort des sentiers battus. Une lecture addictive qui vous poussera à remettre en question tout ce que vous pensiez savoir sur les apparences. https://lafemmedemenagepdf.site/ Site Pour Télécharger La Femme De Ménage

Ne manquez pas ce roman exceptionnel disponible en format fichier pour une lecture moderne. Ce PDF est la solution parfaite pour accéder rapidement à une histoire de qualité supérieure. Préparez-vous à être bouleversé par la sincérité et la profondeur de ce récit d’amour. https://atoutjamaispdf.site/ Ebook À Tout Jamais Français

Découvrez pourquoi ce livre reste un best-seller mondial des décennies après sa sortie. La facilité d’accès du format numérique y contribue grandement. En cherchant Le Petit Prince en PDF, vous rejoignez une communauté de lecteurs passionnés par la beauté simple et la vérité de ce conte. https://lepetitprincepdf.site/ Livre Le Petit Prince Pdf

Find the courage to love deeply. The Great Big Beautiful Life PDF is a great ocean. It holds big water for a beautiful life. Download the document to dive into love. https://greatbigbeautifullifepdf.site/ Great Big Beautiful Life Pdf

Pour comprendre la valeur d’une rose ou l’importance des rites, rien ne vaut cette lecture. Le support numérique en facilite l’accès pour tous. Avoir Le Petit Prince PDF c’est posséder une clé vers un monde de douceur et de compréhension mutuelle, disponible instantanément. https://lepetitprincepdf.site/ Lire Le Petit Prince En Pdf

L’univers de Saint-Exupéry est un refuge pour l’esprit, un endroit où il fait bon aller. La version électronique est la clé de ce refuge. Avoir Le Petit Prince PDF, c’est avoir la clé de ce jardin secret toujours dans sa poche, prêt à vous accueillir. https://lepetitprincepdf.site/ Le Petit Prince Pdf Gratuit Illustré

Un livre qui se dévore du début à la fin, disponible en format électronique pour tous. L’intrigue autour de cette femme de ménage est construite comme un puzzle mortel. Téléchargez le document et essayez d’assembler les pièces avant que le piège ne se referme sur l’héroïne. https://lafemmedemenagepdf.site/ La Femme De Ménage Film

Discover the power of forgiveness. The Great Big Beautiful Life PDF is a great rain. It washes big dirt for a beautiful life. This file cleanses the soul. https://greatbigbeautifullifepdf.site/ Great Big Beautiful Life Torrent

Ce livre est un ami silencieux qui parle fort à notre cœur. La version numérique est discrète et efficace. Le choix de Le Petit Prince en PDF est celui d’une amitié littéraire indéfectible, disponible au bout des doigts pour vous accompagner dans la vie. https://lepetitprincepdf.site/ Le Petit Prince Pdf Deutsch

Discover the joy of learning. The Great Big Beautiful Life PDF is a great school. It teaches big lessons for a beautiful life. This digital document makes learning fun. https://greatbigbeautifullifepdf.site/ How Many Chapters Are In Great Big Beautiful Life

Will Apple Release Iphone 17 When Iphone 17 Air Price India Bajaj Finserv How Much Iphone 17 Pro Max In Usa Thin Iphone 17 Air Case Iphone 17 Price Usa Iphone 17 Price Us Dollars What Are The Expected Specs Of The Iphone 17? Iphone 17 Pro Max Pink Color Rumors

Découvrez pourquoi ce livre est devenu une référence en le lisant confortablement sur votre liseuse. Ce format PDF est conçu pour offrir une expérience de lecture fluide et agréable à tous les passionnés. Une histoire poignante sur la résilience et l’amour qui mérite d’être lue et partagée. https://atoutjamaispdf.site/ À Tout Jamais Pdf Babelio

Ce best-seller est une lecture incontournable pour les amateurs de frissons, disponible en ligne. La version numérique est facile à obtenir et à lire. Découvrez les secrets mortels de cette maison bourgeoise à travers les yeux d’une femme de ménage qui n’est pas au bout de ses peines. https://lafemmedemenagepdf.site/ La Femme De Ménage Pdf Lecture

Discover a story that will stay with you. The Great Big Beautiful Life PDF is a great memory. It leaves big impressions of a beautiful life. This digital file is one you will want to keep and revisit in the years to come. https://greatbigbeautifullifepdf.site/ Who Is Cecil In Great Big Beautiful Life

Stendhal a écrit pour être lu dans cent ans, il a gagné son pari haut la main. C’est un visionnaire. En lisant le rouge et le noir en pdf aujourd’hui, vous validez cette prophétie, prouvant que la grande littérature survit à toutes les évolutions technologiques. https://lerougeetlenoirpdf.site/ Le Rouge Et Le Noir Format Pdf

Sagan a réussi à capturer l’éphémère, ces moments de bonheur fragile qui précèdent la chute. Saisissez ces instants de grâce en lisant le texte en version Bonjour Tristesse PDF, une édition numérique qui fige pour l’éternité la beauté fugace de cet été mythique raconté avec tant de talent. https://bonjourtristessepdf.site/ Bonjour Tristesse Texte Pdf

Partez sur les routes de France avec ce roman à télécharger. Tout le bleu du ciel en pdf est une lecture qui sent bon la liberté et le grand air, un fichier parfait pour s’évader du quotidien et vivre une aventure littéraire exceptionnelle. https://toutlebleuducielpdf.site/ Site Pour Télécharger Tout Le Bleu Du Ciel

Ce livre est un miroir tendu à la jeunesse, reflétant ses espoirs, ses erreurs et sa soif d’absolu. Pour regarder dans ce miroir, téléchargez la version PDF du roman, un format pratique et moderne qui rend ce texte classique accessible à tous, partout et à tout moment. https://bonjourtristessepdf.site/ Bonjour Tristesse Combien De Pages

Les dilemmes moraux de Julien face à l’amour et à la réussite sociale sont d’une modernité surprenante. Pour apprécier pleinement ce texte dense, une version numérique est souvent préférable pour la navigation entre les chapitres. Procurez-vous le rouge et le noir en fichier digital pour une immersion totale dans ce drame passionnel. https://lerougeetlenoirpdf.site/ Le Rouge Et Le Noir Classique Pdf

La beauté des paysages méditerranéens contraste violemment avec la noirceur des sentiments qui animent les personnages. Retrouvez ce clair-obscur littéraire en version Bonjour Tristesse PDF, une édition numérique qui respecte la mise en page et la typographie pour un confort visuel optimal sur tous vos écrans. https://bonjourtristessepdf.site/ Bonjour Tristesse Texte Pdf

Faites entrer la poésie dans votre vie avec ce fichier numérique du célèbre roman. Tout le bleu du ciel est une merveille d’écriture, et cette version ebook vous permet d’emporter cette histoire de résilience partout avec vous, pour lire quelques pages dès que possible. https://toutlebleuducielpdf.site/ Ou Est Tourné Tout Le Bleu Du Ciel

La fin de Julien Sorel est une leçon de dignité face à l’inéluctable. C’est poignant. Le support pdf permet de méditer sur cette fin grandiose, en relisant les derniers chapitres avec la gravité et le recul qu’offre une lecture attentive sur un support de qualité. https://lerougeetlenoirpdf.site/ Le Rouge Et Le Noir Pdf Drive

L’enfance de Maryse Condé est un roman en soi, raconté ici avec brio. Le format numérique permet de l’avoir toujours sous la main. Laissez-vous séduire par ce récit authentique qui explore les joies et les peines d’une vie riche en couleurs. https://lecoeurarireetapleurerpdf.site/ Maryse Condé Le Coeur À Rire Et À Pleurer

Le rouge et le noir est un livre qui se transmet comme un secret précieux entre initiés. C’est culte. La version fichier électronique facilite cette transmission, permettant de partager le fichier et donc le secret avec une communauté élargie de lecteurs passionnés par le génie de Stendhal. https://lerougeetlenoirpdf.site/ Le Rouge Et Le Noir Donne Quelle Couleur

L’émotion est au rendez-vous avec ce roman disponible en version électronique. Téléchargez tout le bleu du ciel et suivez le périple d’un homme qui choisit la vie, une histoire bouleversante à lire confortablement installé avec votre support numérique préféré. https://toutlebleuducielpdf.site/ Ebook Tout Le Bleu Du Ciel Gratuit

Cécile incarne l’adolescence éternelle, avec ses contradictions, ses rêves et ses cruautés involontaires. Rencontrez ce personnage mythique en vous procurant le document Bonjour Tristesse PDF, et plongez dans l’analyse fine et sensible des tourments de la jeunesse par une auteure de génie. https://bonjourtristessepdf.site/ Bonjour Tristesse Pdf Facile

Le rouge et le noir est bien plus qu’un livre, c’est une aventure spirituelle. Lancez-vous. Le téléchargement du pdf est le premier pas de ce voyage, une action simple qui vous ouvre les portes d’un univers complexe et fascinant, prêt à être exploré depuis votre canapé. https://lerougeetlenoirpdf.site/ Le Rouge Et Le Noir Nombre De Pages

Une lecture indispensable pour les amoureux de la nature et des relations humaines, disponible en ebook. Tout le bleu du ciel pdf vous transporte dans un décor somptueux, un fichier à ouvrir dès que l’envie d’évasion se fait sentir pour un moment de pur bonheur littéraire. https://toutlebleuducielpdf.site/ Epub Tout Le Bleu Du Ciel Gratuit

L’ascension fulgurante de Julien Sorel et sa chute vertigineuse sont décrites avec une maîtrise narrative exceptionnelle. Ce roman est un pilier du réalisme français du XIXe siècle. Grâce au format pdf, vous pouvez emporter cette histoire captivante partout avec vous, transformant chaque moment d’attente en un instant de lecture enrichissant. https://lerougeetlenoirpdf.site/ Distribution De Le Rouge Et Le Noir (Film, 1954)

Ce récit est une invitation au voyage intérieur et extérieur. Le livre à télécharger est une opportunité à saisir. Découvrez les souvenirs d’une vie riche, racontés avec une authenticité qui fait de ce livre un compagnon de route précieux et émouvant. https://lecoeurarireetapleurerpdf.site/ Le Coeur A Rire Et A Pleurer Audio

Une lecture qui vous changera, disponible en format fichier pour plus de liberté. Tout le bleu du ciel est un voyage initiatique inoubliable, et cette version numérique est le moyen le plus simple de se plonger dans cette histoire magnifique signée Melissa Da Costa. https://toutlebleuducielpdf.site/ Serie Tout Le Bleu Du Ciel Combien D Épisodes

Wollen Sie sich nicht länger mit Sprachbarrieren abfinden? Unsere PDF-Ratgeber zeigen Ihnen Wege auf, wie Sie fließend Deutsch sprechen können. Nutzen Sie bewährte Techniken und Übungen, um Ihre Fähigkeiten auf ein neues Level zu heben und in jeder Situation die richtigen Worte zu finden. https://becomingfluentingermanpdf.site/ Goethe Institut Exam Preparation Pdf

Möchten Sie Ihre Deutschkenntnisse verbessern oder einfach nur klassische Prosa genießen? Die Sprache der Brüder Grimm ist ein wunderbares Übungsfeld. Am besten eignet sich hierfür eine digitale Ausgabe, wie etwa ein Grimms Märchen PDF, da Sie so unbekannte Wörter leicht markieren und nachschlagen können. https://grimmsmarchenpdf.site/ Wer Hat Die Rechte An Grimms Märchen

Machen Sie Deutsch zu Ihrer Stärke. Unsere PDF-Unterlagen helfen beim Muskelaufbau. Werden Sie „fluent“ und nutzen Sie Ihre Sprachkenntnisse als Wettbewerbsvorteil. https://becomingfluentingermanpdf.site/ Pdf Guide To Learning German

Wer die unvergleichliche Magie der klassischen Literatur erleben möchte, sollte sich unbedingt die zeitlosen Erzählungen der Brüder Grimm ansehen. Diese Geschichten sind ideal für gemütliche Abende und lassen sich heutzutage bequem als Grimms Märchen PDF auf jedem Tablet oder E-Reader genießen, ganz ohne schweres Buch. https://grimmsmarchenpdf.site/ Wer Wird Millionär Grimms Märchen

Ein gesundes Frühstück ist der beste Start in den Tag, und ein Health-Food Café in Berlin Guide als PDF navigiert dich zu Orten mit Acai-Bowls, Smoothies und glutenfreiem Gebäck, damit du fit und vital in dein Berlin-Abenteuer starten kannst. https://cafeinberlinpdf.site/ Café In Berlin Book Pdf

Wer die Brüder Grimm nur als Märchenonkel sieht, tut ihnen unrecht. Sie waren ernsthafte Forscher. Entdecken Sie die wissenschaftliche Akribie hinter den Texten in einer gut kommentierten Grimms Märchen PDF, die auch Hintergründe zur Entstehung beleuchtet. https://grimmsmarchenpdf.site/ Grimms Märchen Und Verbrechen, Staffel 1

Der Klassiker für Schule und Freizeit ist jetzt digital greifbar. Finden Sie Im Westen nichts Neues als PDF und starten Sie sofort mit dem Lesen. Die eindrücklichen Schilderungen des Frontalltags machen diesen Roman zu einem unvergesslichen Erlebnis für Leser jeden Alters. https://imwestennichtsneuespdf.site/ All Quiet On The Western Front Complete Text

Sind Sie auf der Suche nach elektronischem Lesestoff für Ihren E-Reader? Der Klassiker Im Westen nichts Neues steht als PDF zur Verfügung. Lassen Sie sich von der emotionalen Tiefe und der sprachlichen Wucht Remarques mitreißen, ohne ein schweres Buch mit sich herumtragen zu müssen. https://imwestennichtsneuespdf.site/ Wann Kommt Im Westen Nichts Neues Ins Kino