IC MARKETS FEE, SPREADS , COMMISSION REVIEW :

USD 200

ASIC

Trading Desk

Trading DeskMetaTrader 4

Yes

Total Pairs

Total Pairs65

Yes

Low

Account Activation Time

Account Activation Time24 Hours

Visit Broker

Visit Broker

Table of Contents

In general, online brokerages charge lower brokerage fees than traditional brokerages do – this is largely due to the fact that online brokerages’ businesses can be scaled much better: From a technical perspective, it doesn’t make that much of a difference whether they have 10 clients or 5000 clients.

However, this does not imply that they do not charge any fees at all.

You will be charged a fee at various events. You should usually lookout for these 3 types of fees:

Fees for trading: these are brokerage fees that you pay when you purchase an Apple stock or an ETF. A commission, spread, or financing rate is what you pay.

Some brokers apply all three. :

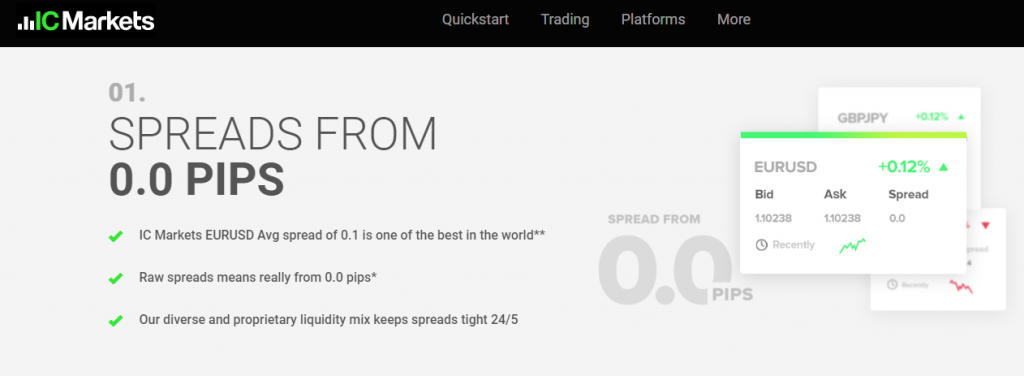

The spread is the difference between the buy price and the selling price.

The commission is either fixed or based on the volume of trades.

If you hold leveraged positions for more than one day, you are charged a financing rate or overnight rate.

Non-trading fees: These occur related to some operations you make in your account, i.e. depositing money to your account, withdrawing money from it or not trading for an extended amount of time.

The fees charged by IC Markets are generally low. Brokers don't charge brokerage fees for services that other brokers do, or they charge a small amount. Thus, you can use IC Markets even if you trade frequently, such as multiple times a week or every day. The following is a high level overview of IC Markets's fees

IC Markets trading fees:

Trading fees at IC Markets are low.

Forex brokers’ trading fees are extremely hard to compare.Rather than providing long fee tables, we compare brokers by calculating all fees of an example trade for two currency pairs.

two of the most populars currencys pairs is EURUSD and EURGBP.

This super catch-all benchmark incorporates spreads and financing costs for all representatives.

EURUSD Test Fee : $5.8

EURUSD Test Fee : $7.3

EURUSD financing rate: 1.2% (Swap)

EURGBP financing rate: 1.5% (Swap)

Currency conversion fee:

IC Markets will charge a Currency Conversion Fee for all exchanges on instruments named in a cash different to the money of your account. The expense is charged as the accompanying: Exchange rate got from liquidity suppliers in addition to an increase

IC Markets non-trading fees

With regards to checking out all the non-trading expenses IC Markets is a modest intermediary. This implies that they don’t charge you a great deal for non-trading related exercises on your trading account, similar to withdrawal expense.

Non-trading expenses incorporate different business expenses and charges at IC Markets that you pay not connected with trading resources. Among some others, regular non trading expenses are withdrawal charge, store expense, latency charge and account charge.

IC Markets withdrawal fee

Deposit fees are applied when you send money to your trading account from your bank account. Usually brokers don’t charge money for that and IC Markets is not different: you will see the exact same amount on your brokerage account that you sent by any of the deposit methods IC Markets offers.

IC Markets non-trading fees

Not at all like most of the internet based dealers we have inspected IC Markets doesn’t charge a withdrawal expense. This implies that you’ll see a similar measure of cash on your financial balance that you moved from your investment fund.

IC Markets inactivity fee

IC Markets doesn’t have any significant bearing an inertia expense which is extraordinary in light of the fact that your account won’t be charged regardless of whether you exchange for a more drawn out time .

OUR RATING

18 Comments

The IC Markets trading platform is of institutional quality, making it a great choice for active traders.

IC Markets offers a minimum deposit of 200 and has 180,000 users, making it a popular choice among traders.

I’ve been very impressed with the fast and efficient execution on IC Markets.

I’ve found IC Markets to be a reliable and trustworthy broker for my trading needs.

IC Markets has been a great choice for me as a trader, the platform is very user-friendly, and customer service is top-notch.

IC Markets has a great reputation in the industry and it’s easy to see why after trading with them for a while.

IC Markets has a great mobile trading app, which makes it easy to keep track of my trades on the go.

IC Markets has a great reputation for providing fast and efficient execution, making it a great choice for traders.

Thanks for finally writing about > How Much Commission Does

IC Market Charge? – List Best Forex Brokers < Liked it!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/uk-UA/register-person?ref=XZNNWTW7

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/es/register?ref=RQUR4BEO

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/es-MX/register?ref=GJY4VW8W

Yo 2jlph! Had a blast playing on this site. It’s pretty straight forward and easy to use. You guys should give it a try if you’re looking for something new – 2jlph

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.boomacious.com/1906/#comment-3129

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.info/register?ref=IHJUI7TF